Answered step by step

Verified Expert Solution

Question

1 Approved Answer

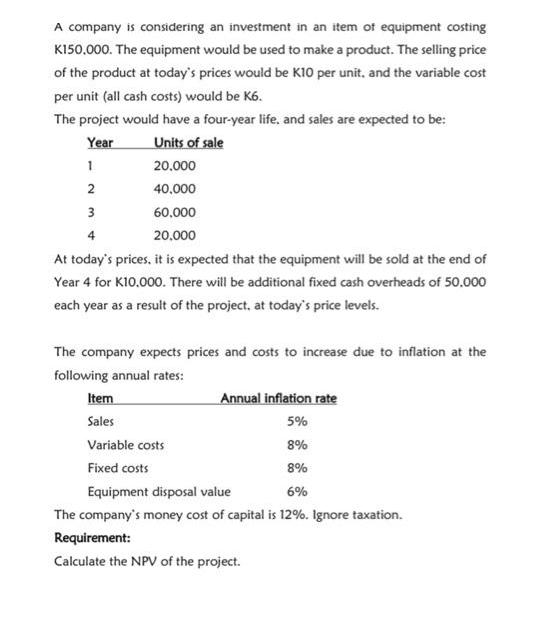

A company is considering an investment in an item of equipment costing K150.000. The equipment would be used to make a product. The selling

A company is considering an investment in an item of equipment costing K150.000. The equipment would be used to make a product. The selling price of the product at today's prices would be K10 per unit, and the variable cost per unit (all cash costs) would be K6. The project would have a four-year life, and sales are expected to be: Year Units of sale 20.000 40,000 60,000 20.000 At today's prices, it is expected that the equipment will be sold at the end of Year 4 for K10,000. There will be additional fixed cash overheads of 50,000 each year as a result of the project, at today's price levels. 1 2 3 The company expects prices and costs to increase due to inflation at the following annual rates: Item Sales Annual inflation rate 5% 8% 8% Equipment disposal value 6% The company's money cost of capital is 12%. Ignore taxation. Variable costs Fixed costs Requirement: Calculate the NPV of the project.

Step by Step Solution

★★★★★

3.56 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Required Net Present Value NPV of the project year 1 year 2 year 3 year 4 Sales Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started