Answered step by step

Verified Expert Solution

Question

1 Approved Answer

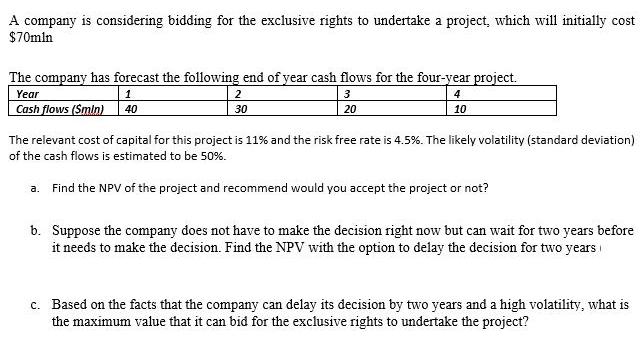

A company is considering bidding for the exclusive rights to undertake a project, which will initially cost $70mln The company has forecast the following

A company is considering bidding for the exclusive rights to undertake a project, which will initially cost $70mln The company has forecast the following end of year cash flows for the four-year project. Year Cash flows (Smin) 1 40 2 30 3 20 4 10 The relevant cost of capital for this project is 11% and the risk free rate is 4.5%. The likely volatility (standard deviation) of the cash flows is estimated to be 50%. a. Find the NPV of the project and recommend would you accept the project or not? b. Suppose the company does not have to make the decision right now but can wait for two years before it needs to make the decision. Find the NPV with the option to delay the decision for two years c. Based on the facts that the company can delay its decision by two years and a high volatility, what is the maximum value that it can bid for the exclusive rights to undertake the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To find the Net Present Value NPV of the project we need to discount the cash flows to their present value and subtract the initial cost Using the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started