Question

A company is considering buying a machine that would give a net cost savings of 60,000 per year for 10 years. The cost of

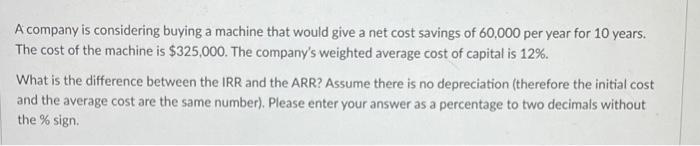

A company is considering buying a machine that would give a net cost savings of 60,000 per year for 10 years. The cost of the machine is $325,000. The company's weighted average cost of capital is 12%. What is the difference between the IRR and the ARR? Assume there is no depreciation (therefore the initial cost and the average cost are the same number). Please enter your answer as a percentage to two decimals without the % sign.

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

The IRR Internal Rate of Return and ARR Accounting Rate of Return are two different methods for eval...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Business Statistics A Decision Making Approach

Authors: David F. Groebner, Patrick W. Shannon, Phillip C. Fry

9th Edition

013302184X, 978-0133021844

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App