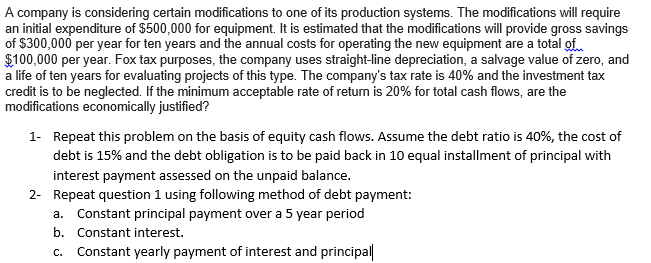

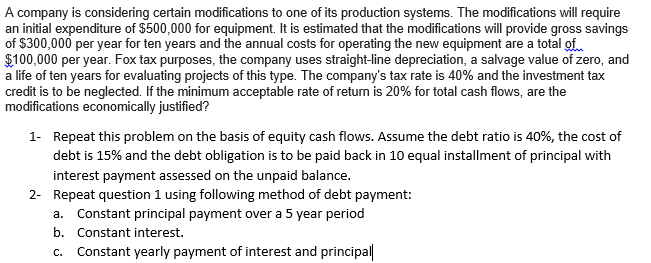

A company is considering certain modifications to one of its production systems. The modifications will require an initial expenditure of $500,000 for equipment. It is estimated that the modifications will provide gross savings of $300,000 per year for ten years and the annual costs for operating the new equipment are a total of $100,000 per year. Fox tax purposes, the company uses straight-line depreciation, a salvage value of zero, and a life of ten years for evaluating projects of this type. The company's tax rate is 40% and the investment tax credit is to be neglected. If the minimum acceptable rate of return is 20% for total cash flows, are the modifications economically justified? -Repeat this problem on the basis of equity cash flows. Assume the debt ratio is 40%, the cost of debt is 15% and the debt obligation is to be paid back in 10 equal installment of principal with interest payment assessed on the unpaid balance Repeat question 1 using following method of debt payment: a. 2- Constant principal payment over a 5 year period Constant interest. Constant yearly payment of interest and principal b. c. A company is considering certain modifications to one of its production systems. The modifications will require an initial expenditure of $500,000 for equipment. It is estimated that the modifications will provide gross savings of $300,000 per year for ten years and the annual costs for operating the new equipment are a total of $100,000 per year. Fox tax purposes, the company uses straight-line depreciation, a salvage value of zero, and a life of ten years for evaluating projects of this type. The company's tax rate is 40% and the investment tax credit is to be neglected. If the minimum acceptable rate of return is 20% for total cash flows, are the modifications economically justified? -Repeat this problem on the basis of equity cash flows. Assume the debt ratio is 40%, the cost of debt is 15% and the debt obligation is to be paid back in 10 equal installment of principal with interest payment assessed on the unpaid balance Repeat question 1 using following method of debt payment: a. 2- Constant principal payment over a 5 year period Constant interest. Constant yearly payment of interest and principal b. c