Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is considering in acquiring a local Waste-to-Energy plant which produces electricity for the energy market by burning wastes collected from the community.

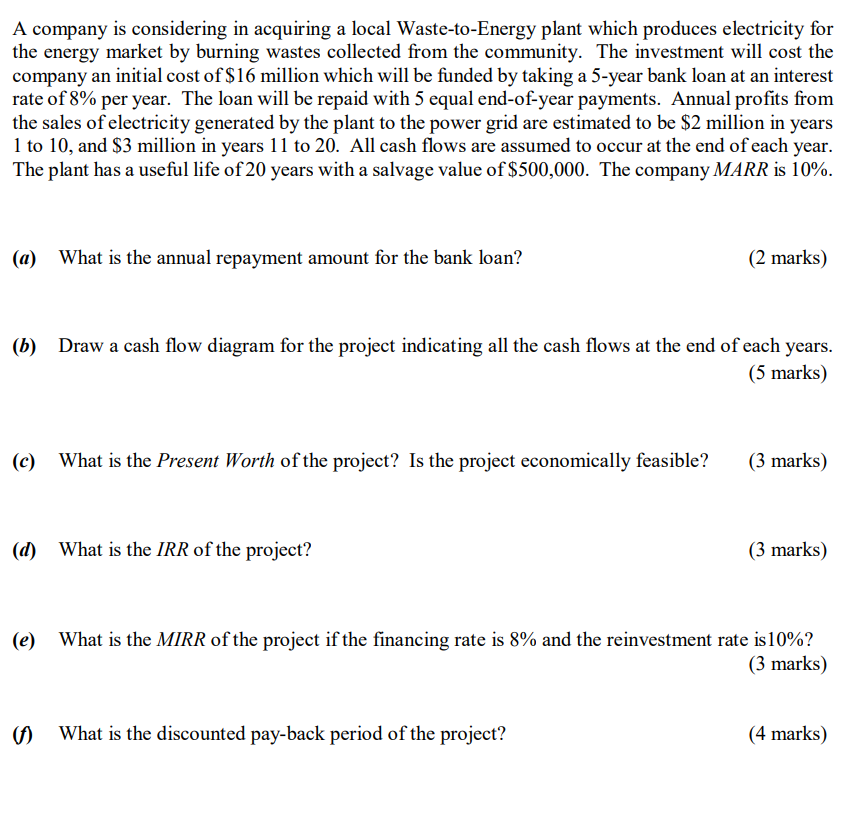

A company is considering in acquiring a local Waste-to-Energy plant which produces electricity for the energy market by burning wastes collected from the community. The investment will cost the company an initial cost of $16 million which will be funded by taking a 5-year bank loan at an interest rate of 8% per year. The loan will be repaid with 5 equal end-of-year payments. Annual profits from the sales of electricity generated by the plant to the power grid are estimated to be $2 million in years 1 to 10, and $3 million in years 11 to 20. All cash flows are assumed to occur at the end of each year. The plant has a useful life of 20 years with a salvage value of $500,000. The company MARR is 10%. (a) What is the annual repayment amount for the bank loan? (b) (2 marks) Draw a cash flow diagram for the project indicating all the cash flows at the end of each years. (5 marks) (c) What is the Present Worth of the project? Is the project economically feasible? (3 marks) (d) What is the IRR of the project? (3 marks) (e) What is the MIRR of the project if the financing rate is 8% and the reinvestment rate is 10%? (3 marks) () What is the discounted pay-back period of the project? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started