A company is considering investing in a new state-of-the-art machine, which initially costs $450,000 and will have a useful life of four years. The

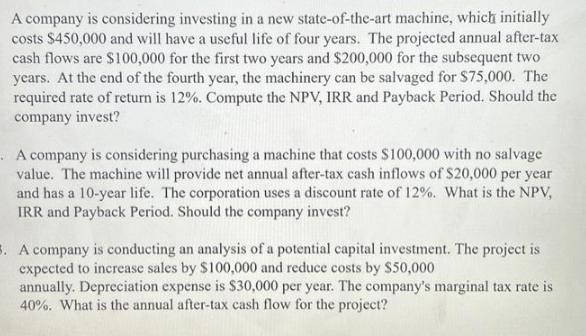

A company is considering investing in a new state-of-the-art machine, which initially costs $450,000 and will have a useful life of four years. The projected annual after-tax cash flows are $100,000 for the first two years and $200,000 for the subsequent two years. At the end of the fourth year, the machinery can be salvaged for $75,000. The required rate of return is 12%. Compute the NPV, IRR and Payback Period. Should the company invest? A company is considering purchasing a machine that costs $100,000 with no salvage value. The machine will provide net annual after-tax cash inflows of $20,000 per year and has a 10-year life. The corporation uses a discount rate of 12%. What is the NPV, IRR and Payback Period. Should the company invest? 3. A company is conducting an analysis of a potential capital investment. The project is expected to increase sales by $100,000 and reduce costs by $50,000 annually. Depreciation expense is $30,000 per year. The company's marginal tax rate is 40%. What is the annual after-tax cash flow for the project?

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 NPV IRR and Payback Period The NPV of the investment can be calculated using the followin...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started