Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is considering investing in a revenue producing asset that has a cost of R5 million. The asset has a useful life of

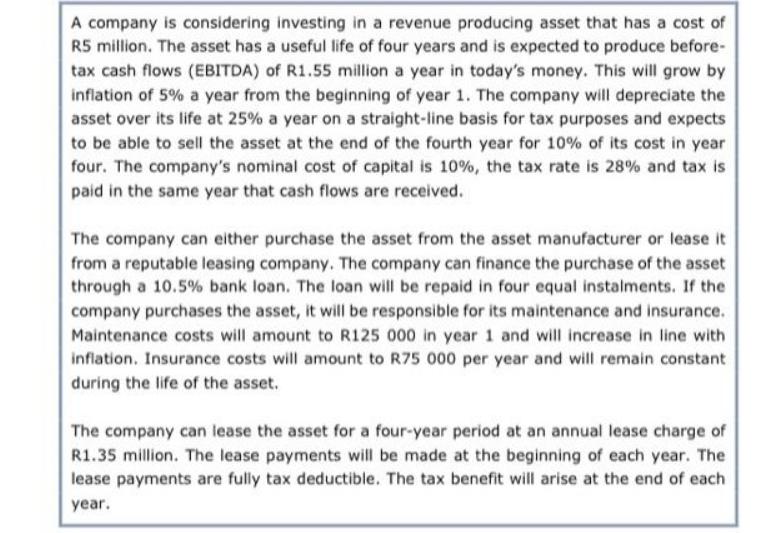

A company is considering investing in a revenue producing asset that has a cost of R5 million. The asset has a useful life of four years and is expected to produce before- tax cash flows (EBITDA) of R1.55 million a year in today's money. This will grow by inflation of 5% a year from the beginning of year 1. The company will depreciate the asset over its life at 25% a year on a straight-line basis for tax purposes and expects to be able to sell the asset at the end of the fourth year for 10% of its cost in year four. The company's nominal cost of capital is 10%, the tax rate is 28% and tax is paid in the same year that cash flows are received. The company can either purchase the asset from the asset manufacturer or lease it from a reputable leasing company. The company can finance the purchase of the asset through a 10.5% bank loan. The loan will be repaid in four equal instalments. If the company purchases the asset, it will be responsible for its maintenance and insurance. Maintenance costs will amount to R125 000 in year 1 and will increase in line with inflation. Insurance costs will amount to R75 000 per year and will remain constant during the life of the asset. The company can lease the asset for a four-year period at an annual lease charge of R1.35 million. The lease payments will be made at the beginning of each year. The lease payments are fully tax deductible. The tax benefit will arise at the end of each year. Required: 1.1 1.2 Calculate the net present value of the asset and advise management whether they should acquire the asset. (10) Using relevant calculations, advise management whether to purchase or lease the asset. (10)

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the net present value NPV of acquiring the asset and compare it to the leasing option To do this well calculate the NPV of the cash flo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started