Answered step by step

Verified Expert Solution

Question

1 Approved Answer

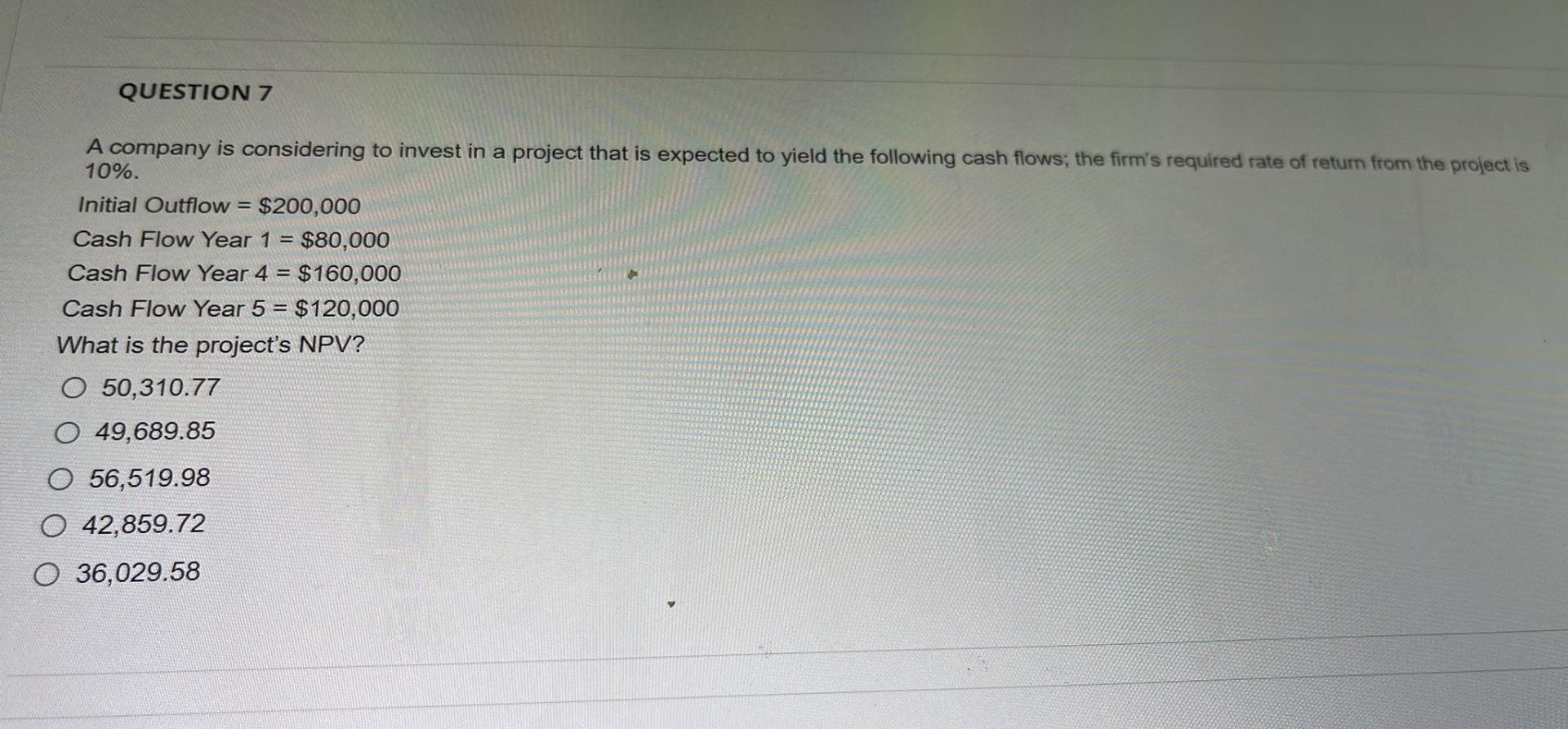

A company is considering to invest in a project that is expected to yield the following cash flows; the firm's required rate of return from

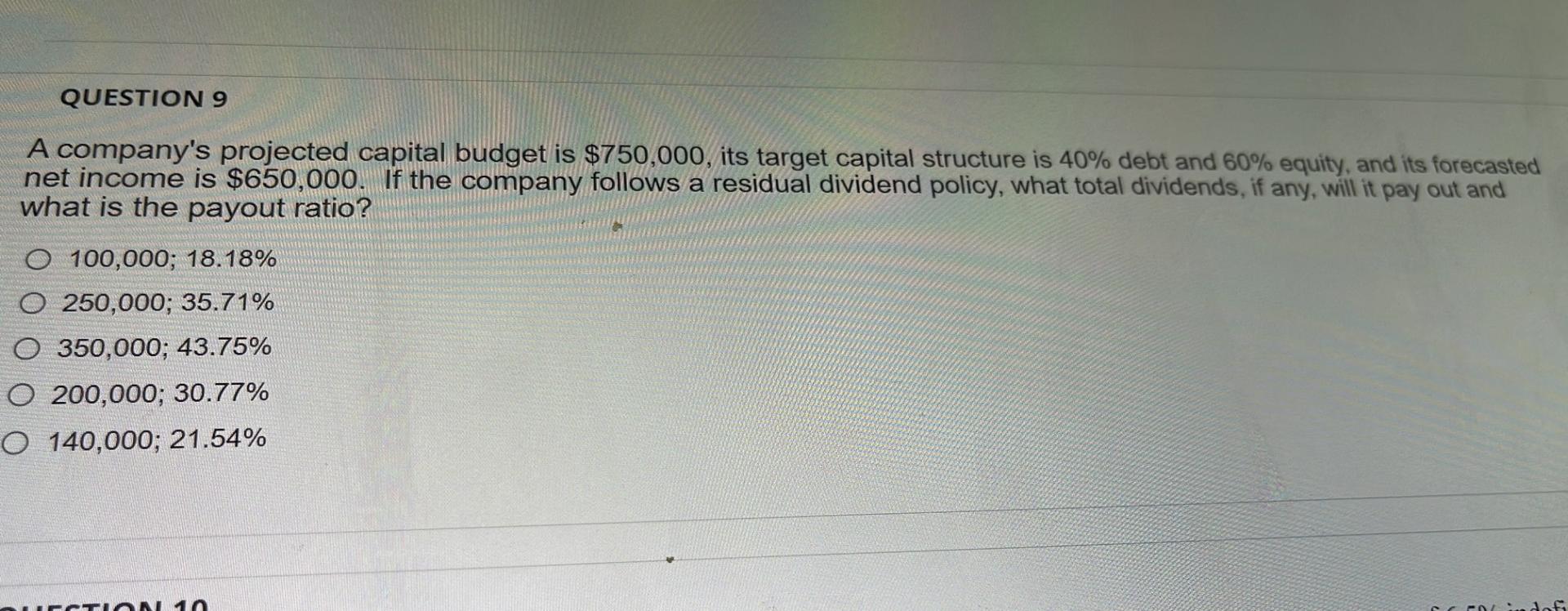

A company is considering to invest in a project that is expected to yield the following cash flows; the firm's required rate of return from the project is 10%. Initial Outflow =$200,000 Cash Flow Year 1=$80,000 Cash Flow Year 4=$160,000 Cash Flow Year 5=$120,000 What is the project's NPV? 50,310.77 49,689.85 56,519.98 42,859.72 36,029.58 A company's projected capital budget is $750,000, its target capital structure is 40% debt and 60% equity, and its forecasted net income is $650,000. If the company follows a residual dividend policy, what total dividends, if any, will it pay out and what is the payout ratio? 100,000;18.18%250,000;35.71%350,000;43.75%200,000;30.77%140,000;21.54%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started