Question

A company is developing a special vehicle for Arctic exploration. The development requires an initial investment of $65,000 and investments of $53,000 and $42,000

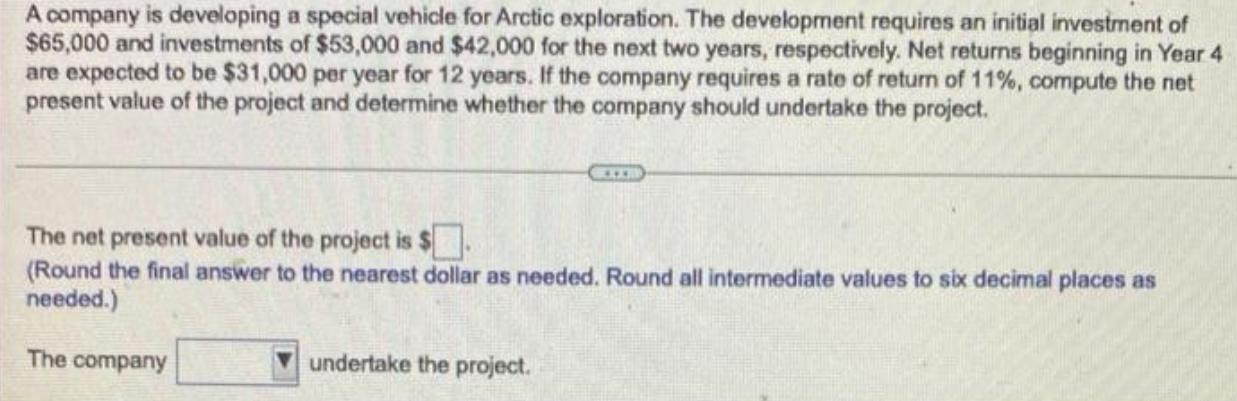

A company is developing a special vehicle for Arctic exploration. The development requires an initial investment of $65,000 and investments of $53,000 and $42,000 for the next two years, respectively. Net returns beginning in Year 4 are expected to be $31,000 per year for 12 years. If the company requires a rate of return of 11%, compute the net present value of the project and determine whether the company should undertake the project. The net present value of the project is (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.) The company undertake the project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of the project and determine whether the company should under...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Business Mathematics with Canadian Applications

Authors: S. A. Hummelbrunner, Kelly Halliday, K. Suzanne Coombs

10th edition

133052311, 978-0133052312

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App