Answered step by step

Verified Expert Solution

Question

1 Approved Answer

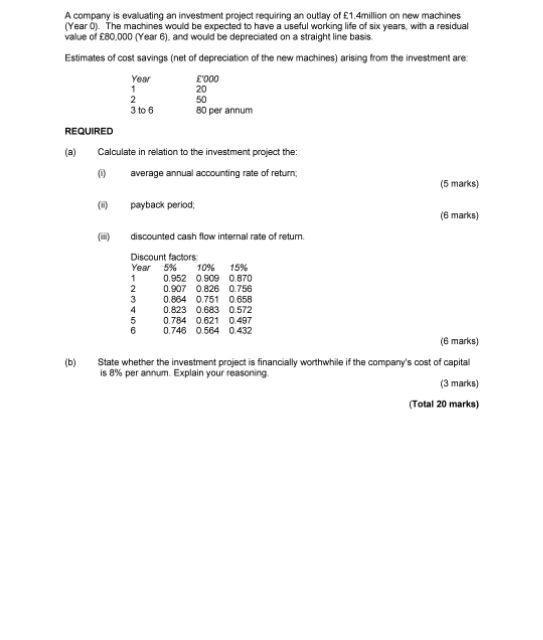

A company is evaluating an investment project requiring an outlay of 1.4million on new machines (Year 0). The machines would be expected to have

A company is evaluating an investment project requiring an outlay of 1.4million on new machines (Year 0). The machines would be expected to have a useful working life of six years, with a residual value of 80.000 (Year 6), and would be depreciated on a straight line basis Estimates of cost savings (net of depreciation of the new machines) arising from the investment are REQUIRED (a) (b) 0 Calculate in relation to the investment project the: average annual accounting rate of return; (0) Year 1 2 3 to 6 (i) '000 20 50 80 per annum payback period, discounted cash flow internal rate of return Discount factors Year 5% 1 2 3 4 5 6 10% 15% 0.952 0.909 0.870 0.907 0.826 0.756 0.864 0.751 0.658 0.823 0.683 0.572 0.784 0.621 0.497 0.746 0.564 0.432 (5 marks) (6 marks) (6 marks) State whether the investment project is financially worthwhile if the company's cost of capital is 8% per annum. Explain your reasoning (3 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started