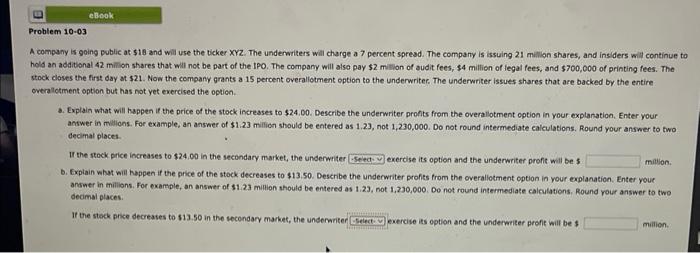

A company is going public at $18 and will use the ticker XYz. The underwiters will charge a 7 percent spread. The company is issuing 21 mithion shares, and ins iders will continue to hold an additional 42 milison shares that will not be part of the IPO. The company will also pay $2 millon of audit fees, $4 million of legat fees, and $700,000 of printing fees. The stock closes the first day at $21. Now the company grants a 15 percent overallotment option to the underwriter. The underwriter issues shares that are backed by the entire overalotment option but has not yet evercised the option. 3. Explain what will happen if the price of the stock incresses to \$24.00. Describe the underwriter prohts from the overaliotment option in your explanation, Enter your answer in milions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Do not round intermediate ealculations. Round your answer to two decimal places. If the stock price increases to $24,00 in the secondary market, the underweiter exercise its option and the underwriter profit will be 5 b. Explain what will happen if the price of the stock decreases to $13.50. Describe the underwriter profits from the overallotment option in your explanation. Enter youe andwer in millions. For example, an answer of $1.23 milion should be entered as 1.23, not 1,230,000. Do not round intermediate calculations. Round your answer to two decimal places. If the stock price decreates to 513.50 in the secondary market, the undernriter exercise its option and the underwiter proft will be 3 A company is going public at $18 and will use the ticker XYz. The underwiters will charge a 7 percent spread. The company is issuing 21 mithion shares, and ins iders will continue to hold an additional 42 milison shares that will not be part of the IPO. The company will also pay $2 millon of audit fees, $4 million of legat fees, and $700,000 of printing fees. The stock closes the first day at $21. Now the company grants a 15 percent overallotment option to the underwriter. The underwriter issues shares that are backed by the entire overalotment option but has not yet evercised the option. 3. Explain what will happen if the price of the stock incresses to \$24.00. Describe the underwriter prohts from the overaliotment option in your explanation, Enter your answer in milions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000. Do not round intermediate ealculations. Round your answer to two decimal places. If the stock price increases to $24,00 in the secondary market, the underweiter exercise its option and the underwriter profit will be 5 b. Explain what will happen if the price of the stock decreases to $13.50. Describe the underwriter profits from the overallotment option in your explanation. Enter youe andwer in millions. For example, an answer of $1.23 milion should be entered as 1.23, not 1,230,000. Do not round intermediate calculations. Round your answer to two decimal places. If the stock price decreates to 513.50 in the secondary market, the undernriter exercise its option and the underwiter proft will be 3