Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is moving its headquarters from a city's central business district to its suburbs where it can find similar amenities but significantly lower

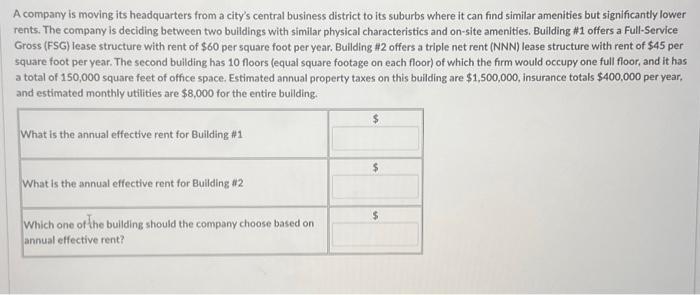

A company is moving its headquarters from a city's central business district to its suburbs where it can find similar amenities but significantly lower rents. The company is deciding between two buildings with similar physical characteristics and on-site amenities. Building #1 offers a Full-Service Gross (FSG) lease structure with rent of $60 per square foot per year. Building #2 offers a triple net rent (NNN) lease structure with rent of $45 per square foot per year. The second building has 10 floors (equal square footage on each floor) of which the firm would occupy one full floor, and it has a total of 150,000 square feet of office space. Estimated annual property taxes on this building are $1,500,000, insurance totals $400,000 per year, and estimated monthly utilities are $8,000 for the entire building. What is the annual effective rent for Building #1 What is the annual effective rent for Building #2 Which one of the building should the company choose based on annual effective rent? $ $ $

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

For Building 1 the annual effective rent is equal to the FullService Gross rent per square foot per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started