Answered step by step

Verified Expert Solution

Question

1 Approved Answer

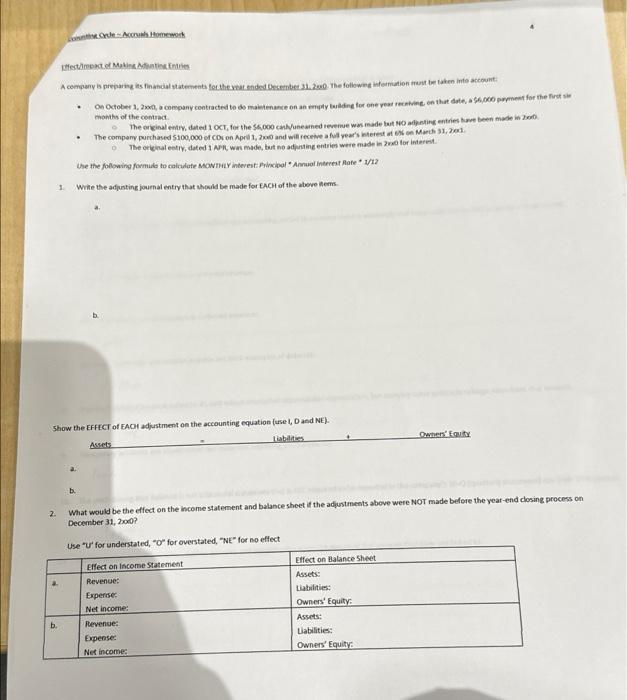

A company is preparing its financial statements for the year ended December 31, 2xx0. The following information must be taken into account: On October 1,

A company is preparing its financial statements for the year ended December 31, 2xx0. The following information must be taken into account: On October 1, 2xx0, a company contracted to do maintenance on an empty building for one year receiving, on that date, a $6,000 payment for the first six months of the contract. O The original entry, dated 1 OCT, for the $6,000 cash/unearned revenue was made but NO adjusting entries have been made in 2xx0. The company purchased $100,000 of CDs on April 1, 2xx0 and will receive a full year's interest at 6% on March 31, 2xx1. O The original entry, dated 1 APR, was made, but no adjusting entries were made in 2xx0 for interest. 1. Show the EFFECT of EACH adjustment on the accounting equation (use I, D and NE). Liabilities a. Use the following formula to calculate MONTHLY interest: Principal Annual Interest Rate * 1/12 Write the adjusting journal entry that should be made for EACH of the above items. b. a. b. Assets What would be the effect on the income statement and balance sheet if the adjustments above were NOT made before the year-end closing process on December 31, 2xx0? Use "U' for understated, "O" for overstated, "NE" for no effect Effect on Income Statement Revenue: Expense: Net income: Revenue: Expense: Net income: Owners' Equity Effect on Balance Sheet Assets: Liabilities: Owners' Equity: Assets: Liabilities: Owners' Equity:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started