Question

A company is trying to decide which of the following two new product lines to introduce in the coming year. The company requires a 12%

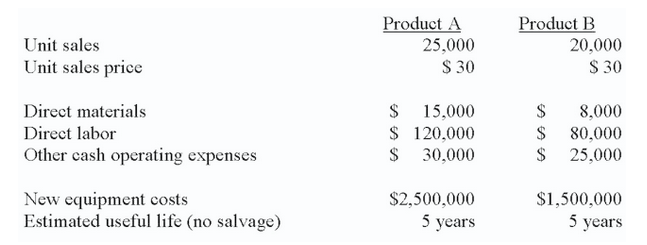

A company is trying to decide which of the following two new product lines to introduce in the coming year. The company requires a 12% return on investment in the equipment purchase. The predicted revenue and cost data for each product line follows:

The company has a 30% tax rate and it uses the straight-line depreciation method.

1.What is the amount of annual net cash inflow from each product?

2.Further, compute the net present value for each piece of equipment based on their respective product line's annual net cash inflow. Which, if either, of these two equipment purchases is acceptable?

Produst A Product B Unit sales Unit sales price 25,000 S30 20,000 S 30 Direct materials Direct labor Other cash operating expenses S 15,000 S 120,000 S 30,000 8,000 80,000 $ 25,000 New equipment costs Estimated useful life (no salvage) $2,500,000 5 years $1,500,000 5 yearsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started