Answered step by step

Verified Expert Solution

Question

1 Approved Answer

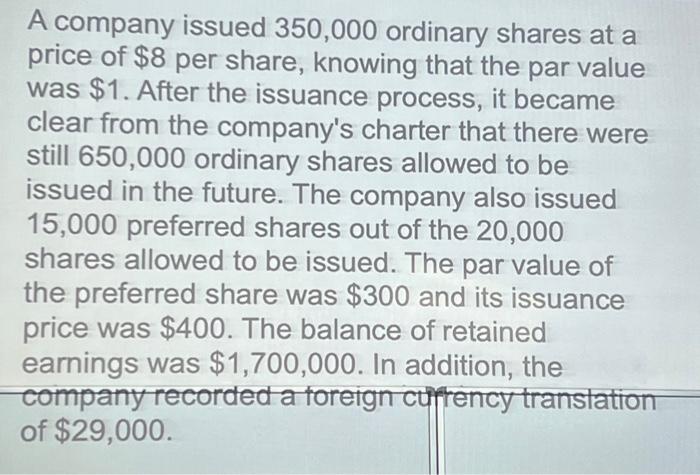

A company issued 350,000 ordinary shares at a price of $8 per share, knowing that the par value was $1. After the issuance process, it

A company issued 350,000 ordinary shares at a price of $8 per share, knowing that the par value was $1. After the issuance process, it became clear from the company's charter that there were still 650,000 ordinary shares allowed to be issued in the future. The company also issued 15,000 preferred shares out of the 20,000 shares allowed to be issued. The par value of the preferred share was $300 and its issuance price was $400. The balance of retained earnings was $1,700,000. In addition, the company recorded a foreign currency translation of $29,000. Calculate the Equity section of a balance sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started