Question

A company issued a five-year bond at Rs 970 two years ago. The bond pays a semi-annual coupon at 8 percent per year. The

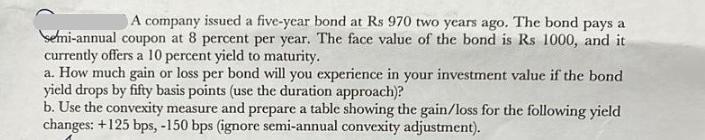

A company issued a five-year bond at Rs 970 two years ago. The bond pays a semi-annual coupon at 8 percent per year. The face value of the bond is Rs 1000, and it currently offers a 10 percent yield to maturity. a. How much gain or loss per bond will you experience in your investment value if the bond yield drops by fifty basis points (use the duration approach)? b. Use the convexity measure and prepare a table showing the gain/loss for the following yield changes: +125 bps, -150 bps (ignore semi-annual convexity adjustment).

Step by Step Solution

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the gain or loss per bond using the duration approach we need to calculate the bonds duration and use it to estimate the percentage chang...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

13th International Edition

1265533199, 978-1265533199

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App