Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company issued term bonds with par value of S200,000, life of 12 years and nominal rate of 7.25% per year. The bonds pay

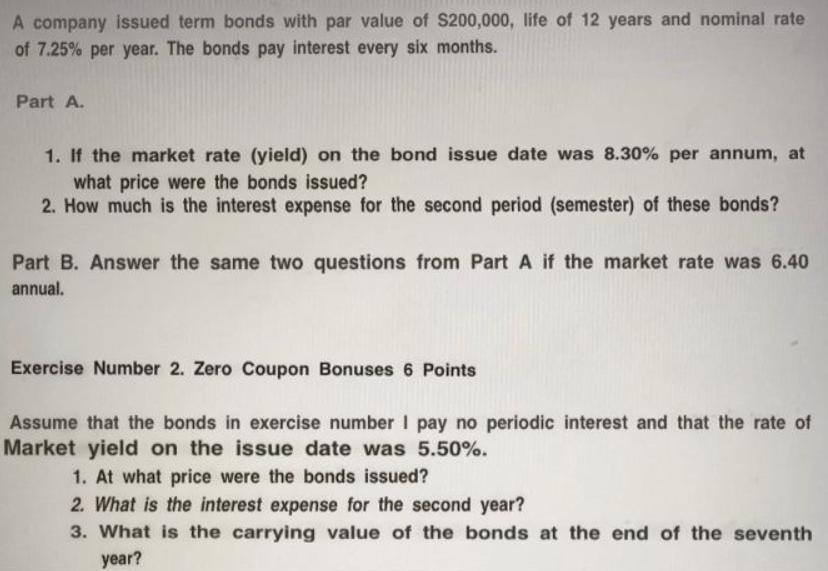

A company issued term bonds with par value of S200,000, life of 12 years and nominal rate of 7.25% per year. The bonds pay interest every six months. Part A. 1. If the market rate (yield) on the bond issue date was 8.30% per annum, at what price were the bonds issued? 2. How much is the interest expense for the second period (semester) of these bonds? Part B. Answer the same two questions from Part A if the market rate was 6.40 annual. Exercise Number 2. Zero Coupon Bonuses 6 Points Assume that the bonds in exercise number I pay no periodic interest and that the rate of Market yield on the issue date was 5.50%. 1. At what price were the bonds issued? 2. What is the interest expense for the second year? 3. What is the carrying value of the bonds at the end of the seventh year?

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part A When the market rate is 830 Issue price 10886221 Interest expense in the second period 440439 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started