Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company issues 4% convertible bonds at their nominal value of $47 million. The bonds may be converted at any time up to maturity

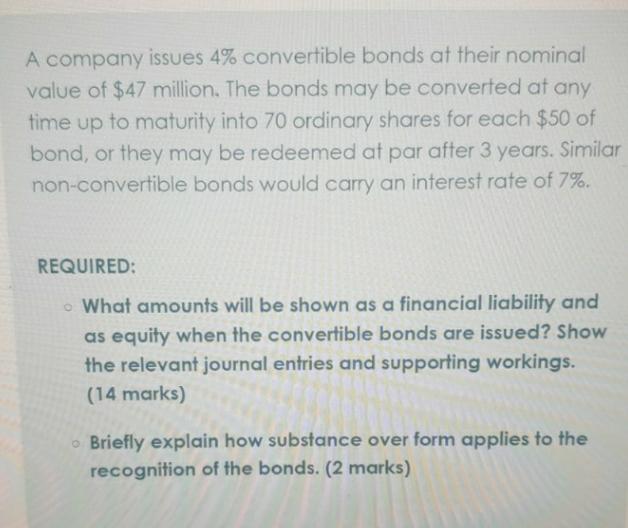

A company issues 4% convertible bonds at their nominal value of $47 million. The bonds may be converted at any time up to maturity into 70 ordinary shares for each $50 of bond, or they may be redeemed at par after 3 years. Similar non-convertible bonds would carry an interest rate of 7%. REQUIRED: What amounts will be shown as a financial liability and as equity when the convertible bonds are issued? Show the relevant journal entries and supporting workings. (14 marks) Briefly explain how substance over form applies to the recognition of the bonds. (2 marks)

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The issuance of the 4 convertible bonds will result in a financial liability and equity being recognized on the companys balance sheet The financial l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started