Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company made the following purchases during the year: 15 units @ $360 each 25 units @ $390 each 10 units @ $420 each

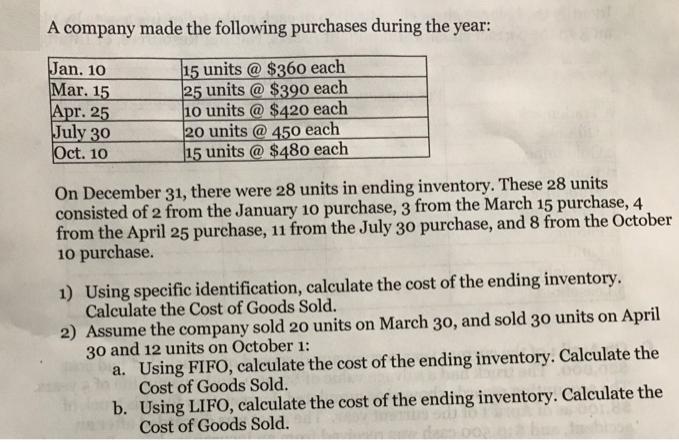

A company made the following purchases during the year: 15 units @ $360 each 25 units @ $390 each 10 units @ $420 each 20 units @ 450 each 15 units @ $480 each Jan. 10 Mar. 15 Apr. 25 July 30 Oct. 10 On December 31, there were 28 units in ending inventory. These 28 units consisted of 2 from the January 10 purchase, 3 from the March 15 purchase, 4 from the April 25 purchase, 11 from the July 30 purchase, and 8 from the October 10 purchase. 1) Using specific identification, calculate the cost of the ending inventory. Calculate the Cost of Goods Sold. 2) Assume the company sold 20 units on March 30, and sold 30 units on April 30 and 12 units on October 1: a. Using FIFO, calculate the cost of the ending inventory. Calculate the Cost of Goods Sold. b. Using LIFO, calculate the cost of the ending inventory. Calculate the Cost of Goods Sold.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Answer 1 SPECIFIC ID METHOD PURHASES COST OF GOODS SOLD ENDING INVENTORY Date Partic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started