Answered step by step

Verified Expert Solution

Question

1 Approved Answer

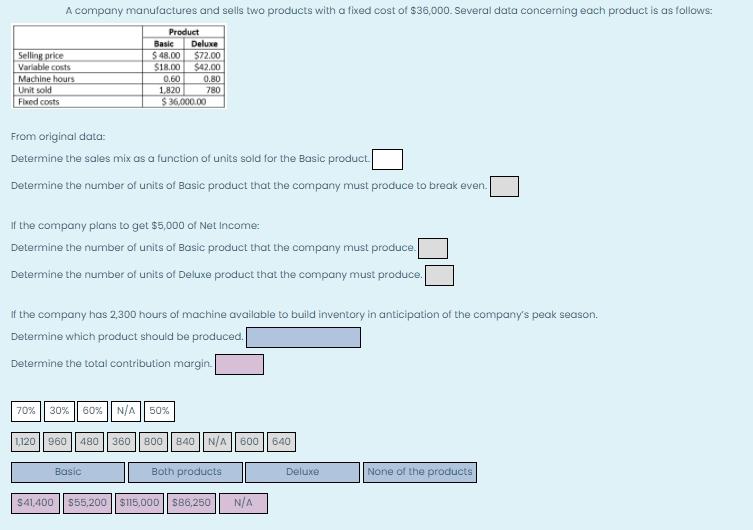

A company manufactures and sells two products with a fixed cost of $36,000. Several data concerning each product is as follows: Deluxe Basic $

A company manufactures and sells two products with a fixed cost of $36,000. Several data concerning each product is as follows: Deluxe Basic $ 48,00 $72.00 $18.00 $42.00 Selling price Variable costs Machine hours Unit sold Fixed costs Product 0.60 1,820 $36,000.00 0.80 780 From original data: Determine the sales mix as a function of units sold for the Basic product. Determine the number of units of Basic product that the company must produce to break even. If the company plans to get $5,000 of Net Income: Determine the number of units of Basic product that the company must produce. Determine the number of units of Deluxe product that the company must produce. If the company has 2,300 hours of machine available to build inventory in anticipation of the company's peak season. Determine which product should be produced. Determine the total contribution margin. 70% 30% 60% N/A 50% Basic 1,120 960 480 360 800 840 N/A 600 640 Both products $41,400 $55,200 $115,000 $86,250 N/A Deluxe None of the products

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a b d e f selling price variable cost contribution margin number of units sold contribution fixed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started