Answered step by step

Verified Expert Solution

Question

1 Approved Answer

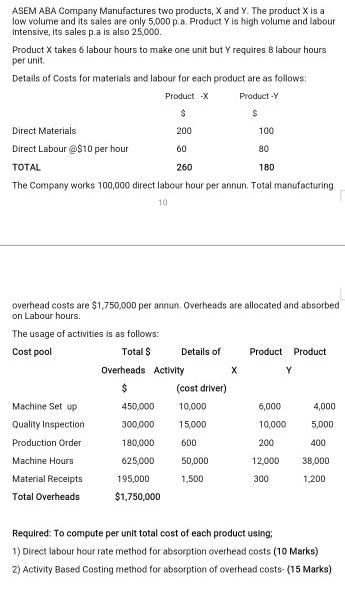

ASEM ABA Company Manufactures two products, X and Y. The product X is a low volume and its sales are only 5,000 p.a. Product

ASEM ABA Company Manufactures two products, X and Y. The product X is a low volume and its sales are only 5,000 p.a. Product Y is high volume and labour intensive, its sales p.a is also 25,000. Product X takes 6 labour hours to make one unit but y requires 8 labour hours per unit. Details of Costs for materials and labour for each product are as follows: Product -X $ 200 Direct Materials Direct Labour @$10 per hour TOTAL 100 80 180 The Company works 100,000 direct labour hour per annun. Total manufacturing 10 The usage of activities is as follows: Cost pool Total $ overhead costs are $1,750,000 per annun, Overheads are allocated and absorbed on Labour hours. Machine Set up Quality Inspection Production Order Machine Hours Material Receipts Total Overheads 60 260 450,000 300,000 180,000 625,000 Overheads Activity $ 195,000 $1,750,000 Details of (cost driver) 10,000 15,000 600 Product-Y $ 50,000 1,500 X Product Product Y 6,000 10,000 200 12,000 300 4,000 5,000 400 38,000 1,200 Required: To compute per unit total cost of each product using; 1) Direct labour hour rate method for absorption overhead costs (10 Marks) 2) Activity Based Costing method for absorption of overhead costs-(15 Marks)

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Computation of Total cost p u Overhead absorption based on direct labor hours C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started