Answered step by step

Verified Expert Solution

Question

1 Approved Answer

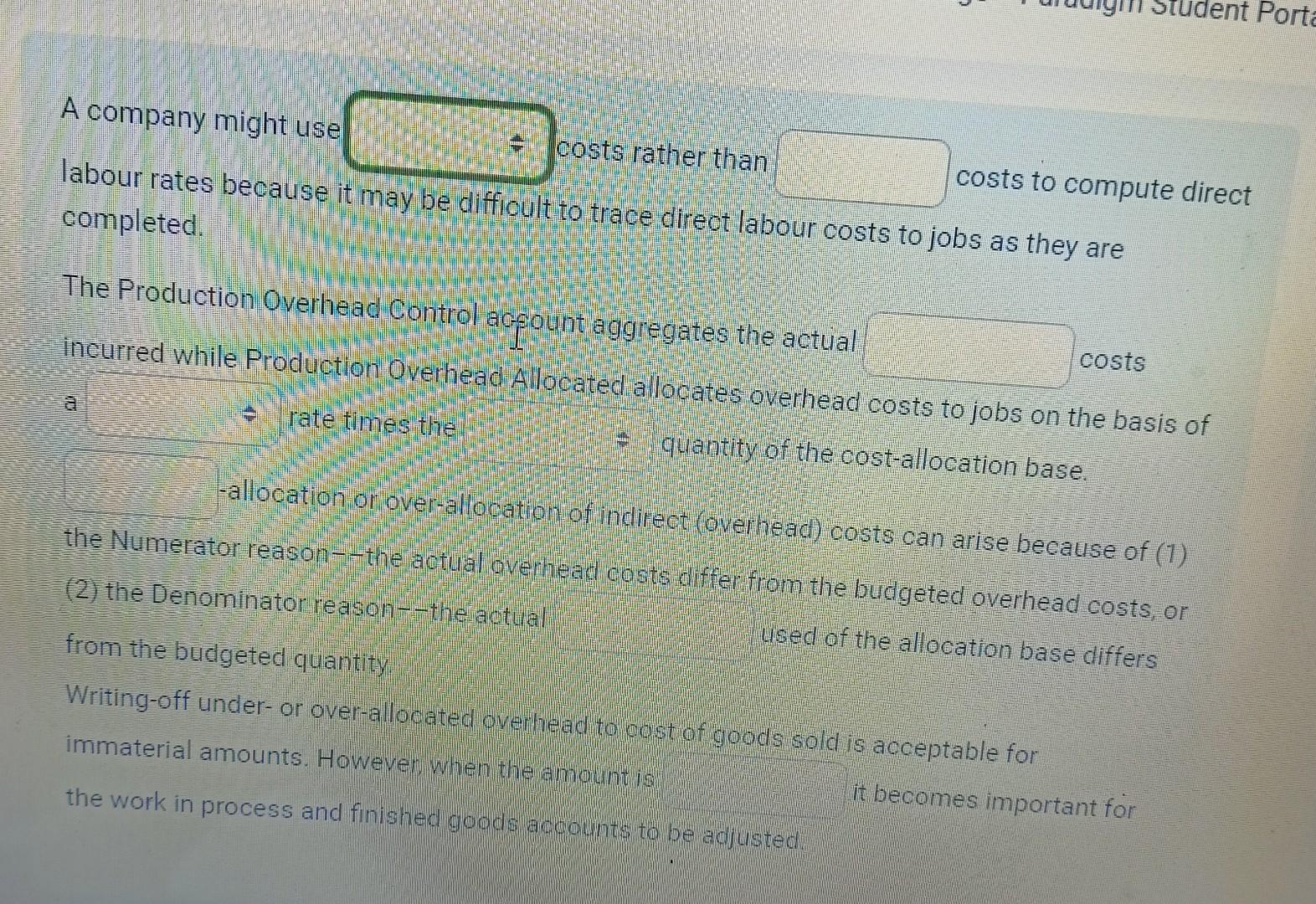

A company might use costs rather than labour rates because it may be difficult to trace direct labour costs to jobs as they are completed.

A company might use costs rather than labour rates because it may be difficult to trace direct labour costs to jobs as they are completed. The Production Overhead Control aceount aggregates the actual incurred while Production Qverhead Allocated allocates overhead costs to jobs on the basis of a - rate times the * quantity of the cost-allocation base. -allocation or over-allocation of indirect (overhead) costs can arise because of ( 1 ) the Numerator reason--the actual overhead costs differ from the budgeted overhead costs, or (2) the Denominator reason--the actual from the budgeted quantity. used of the allocation base differs Writing-off under- or over-allocated overhead to cost of goods sold is acceptable for immaterial amounts. However, when the amount is the work in process and finished goods accounts to be adjusted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started