Question

A company named Acme previously succcessful in another line of products, was encouraged to look for other opportunities and launched the mini Crane for use

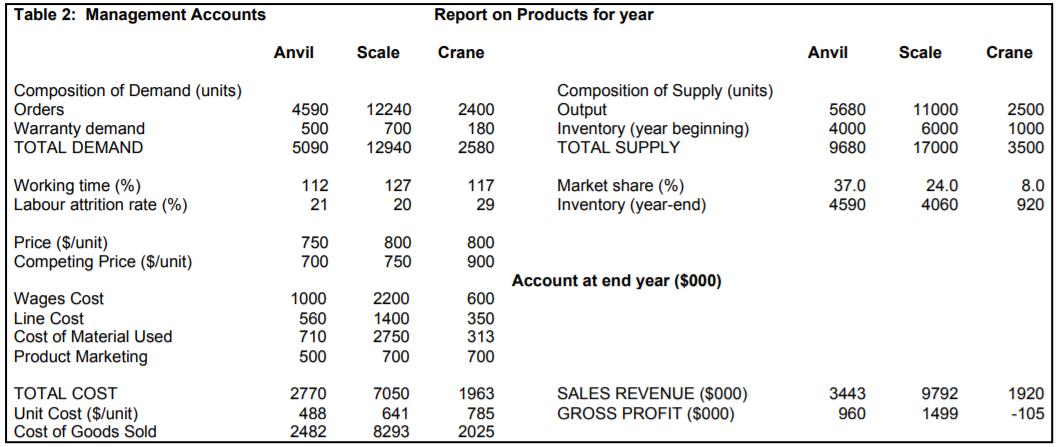

A company named Acme previously succcessful in another line of products, was encouraged to look for other opportunities and launched the mini Crane for use in the construction trade. The market for cranes is dominated by LiftTech, a global leader in industrial lifting solutions, and Acme has found it hard to transfer its previous success into this fast-growing and competitive market. The Operations Director expects the attrition rate to worsen dramatically in the near future and that this could have an impact on quality of output. The Finance Director was more sanguine, noting that Acme has a high Gross Profit, healthy Cash Flow and plenty of inventories. He said, ‘We have kept to our objective of never having to borrow. The recent share price fall is due to short-term investors and unjustified reports in the financial press.’ The CEO was fairly optimistic. He said, ‘The Crane is taking time to respond to changes I implemented last year. The price increase was designed to increase profits, but market share has fallen from 10% to 8% already. I have every confidence in this product and we will achieve the synergies we were looking.

Required:

1) Assess the situation using financial and strategic analysis. Is the ‘no firing’ policy likely to be the solution to Acme’s problems?

2) Analyse Acme’s strategic position and suggest a set of options for the short run and the long run.

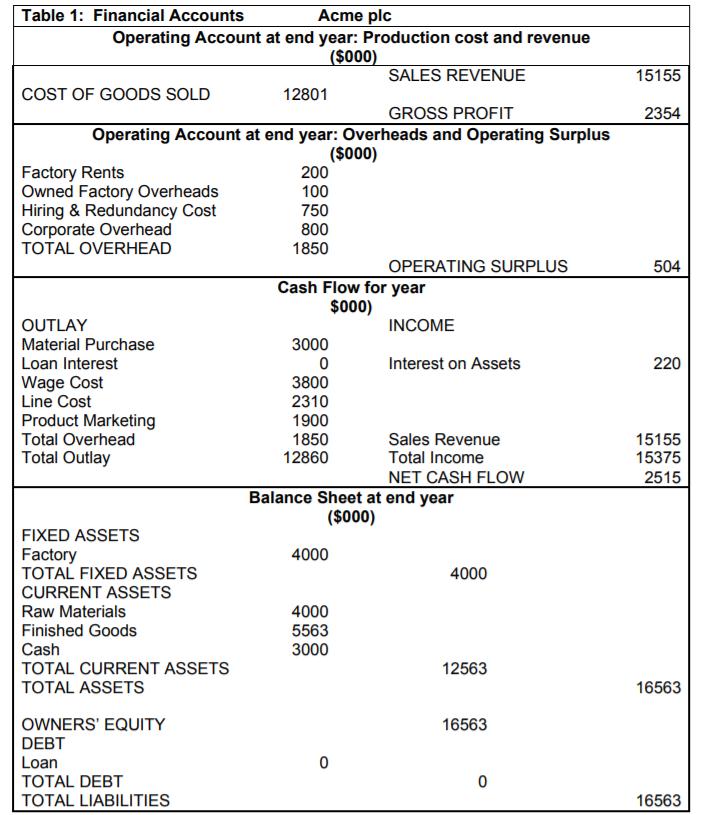

Acme plc Operating Account at end year: Production cost and revenue ($000) Table 1: Financial Accounts SALES REVENUE 15155 COST OF GOODS SOLD 12801 GROSS PROFIT 2354 Operating Account at end year: Overheads and Operating Surplus ($000) 200 100 Factory Rents Owned Factory Overheads Hiring & Redundancy Cost Corporate Overhead TOTAL OVERHEAD 750 800 1850 OPERATING SURPLUS 504 Cash Flow for year $000) OUTLAY INCOME Material Purchase Loan Interest 3000 Interest on Assets 220 Wage Cost Line Cost 3800 2310 1900 Product Marketing Total Overhead Total Outlay Sales Revenue Total Income 1850 15155 15375 12860 NET CASH FLOW 2515 Balance Sheet at end year ($000) FIXED ASSETS Factory TOTAL FIXED ASSETS 4000 4000 CURRENT ASSETS Raw Materials Finished Goods Cash TOTAL CURRENT ASSETS 4000 5563 3000 12563 TOTAL ASSETS 16563 OWNERS' EQUITY DEBT 16563 Loan TOTAL DEBT TOTAL LIABILITIES 16563

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Measuring the financial distress is the short run option which Acme must do immediately like Altmans Z Score model Altmans function was fitted as fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started