Answered step by step

Verified Expert Solution

Question

1 Approved Answer

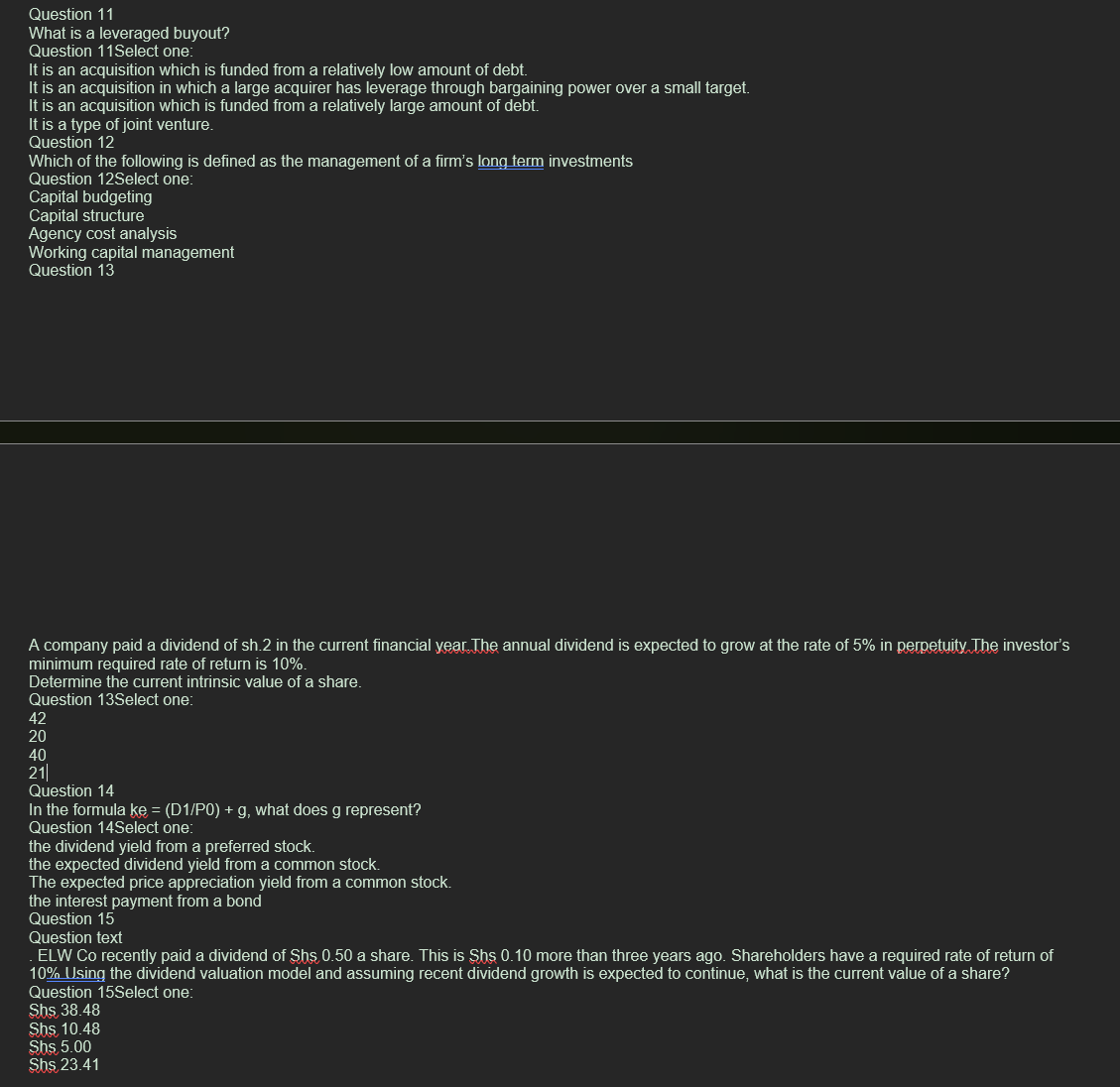

A company paid a dividend of sh . 2 in the current financial year. The annual dividend is expected to grow at the rate of

A company paid a dividend of sh in the current financial year. The annual dividend is expected to grow at the rate of in perpetuity The investor's

minimum required rate of return is

Determine the current intrinsic value of a share.

Question Select one:

Question

In the formula what does g represent?

Question Select one:

the dividend yield from a preferred stock.

the expected dividend yield from a common stock.

The expected price appreciation yield from a common stock.

the interest payment from a bond

Question

Question text

ELW Co recently paid a dividend of Shs a share. This is Shs more than three years ago. Shareholders have a required rate of return of

Using the dividend valuation model and assuming recent dividend growth is expected to continue, what is the current value of a share?

Question Select one:

Sbs

Shs

Shs

Sbs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started