Question

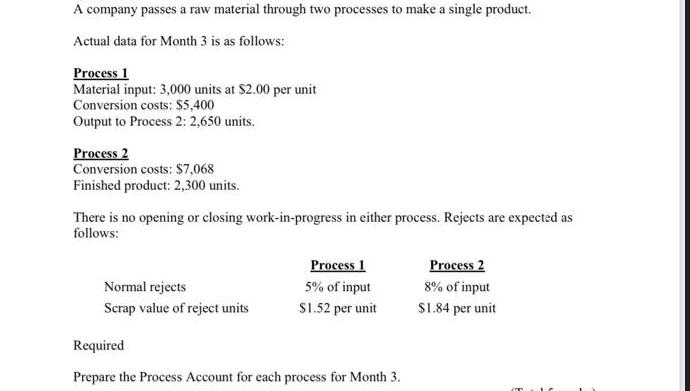

A company passes a raw material through two processes to make a single product. Actual data for Month 3 is as follows: Process 1

A company passes a raw material through two processes to make a single product. Actual data for Month 3 is as follows: Process 1 Material input: 3,000 units at $2.00 per unit Conversion costs: $5,400 Output to Process 2: 2,650 units. Process 2 Conversion costs: $7,068 Finished product: 2,300 units. There is no opening or closing work-in-progress in either process. Rejects are expected as follows: Normal rejects Scrap value of reject units Process 1 5% of input $1.52 per unit Required Prepare the Process Account for each process for Month 3. Process 2 8% of input $1.84 per unit

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Step 1Determine output and losses Normal loss 5 3000 150 units 100 Expected output Input normal loss 3000 150 2850 units Actual output 2650 units Abno...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management and Cost Accounting

Authors: Colin Drury

8th edition

978-1408041802, 1408041804, 978-1408048566, 1408048566, 978-1408093887

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App