Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company plans to raise $100 million (This is the gross amount before costs come off.) through an IPO. The company sets the IPO

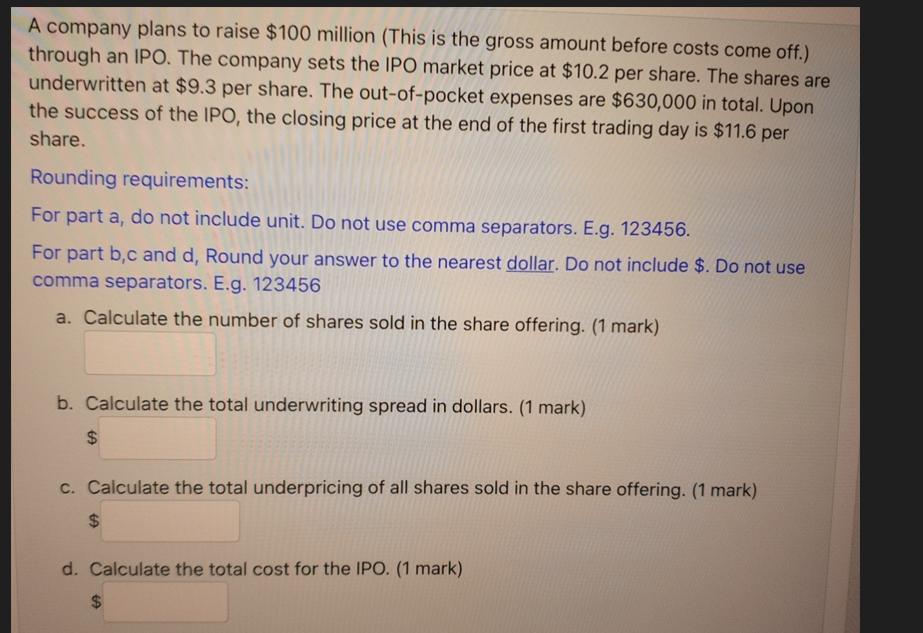

A company plans to raise $100 million (This is the gross amount before costs come off.) through an IPO. The company sets the IPO market price at $10.2 per share. The shares are underwritten at $9.3 per share. The out-of-pocket expenses are $630,000 in total. Upon the success of the IPO, the closing price at the end of the first trading day is $11.6 per share. Rounding requirements: For part a, do not include unit. Do not use comma separators. E.g. 123456. For part b,c and d, Round your answer to the nearest dollar. Do not include $. Do not use comma separators. E.g. 123456 a. Calculate the number of shares sold in the share offering. (1 mark) b. Calculate the total underwriting spread in dollars. (1 mark) $ c. Calculate the total underpricing of all shares sold in the share offering. (1 mark) $ d. Calculate the total cost for the IPO. (1 mark) 6

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

A B C D 12 Information we have Amount need to raise 3 4 IPO Market Pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started