Question

A company provided a special promotion of zero-interest financing for 3 years on its products. The company received a $396,000 zero-interest- bearing note on

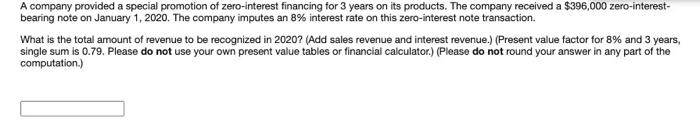

A company provided a special promotion of zero-interest financing for 3 years on its products. The company received a $396,000 zero-interest- bearing note on January 1, 2020. The company imputes an 8% interest rate on this zero-interest note transaction. What is the total amount of revenue to be recognized in 2020? (Add sales revenue and interest revenue.) (Present value factor for 8% and 3 years, single sum is 0.79. Please do not use your own present value tables or financial calculator.) (Please do not round your answer in any part of the computation.)

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Sales RevenueAmount to be r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

4th Edition

1119607515, 978-1119607519

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App