Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company provides cost-effective solutions for managing regulatory requirements and the company needs specific to the airline industry. Assume that on July 1 the

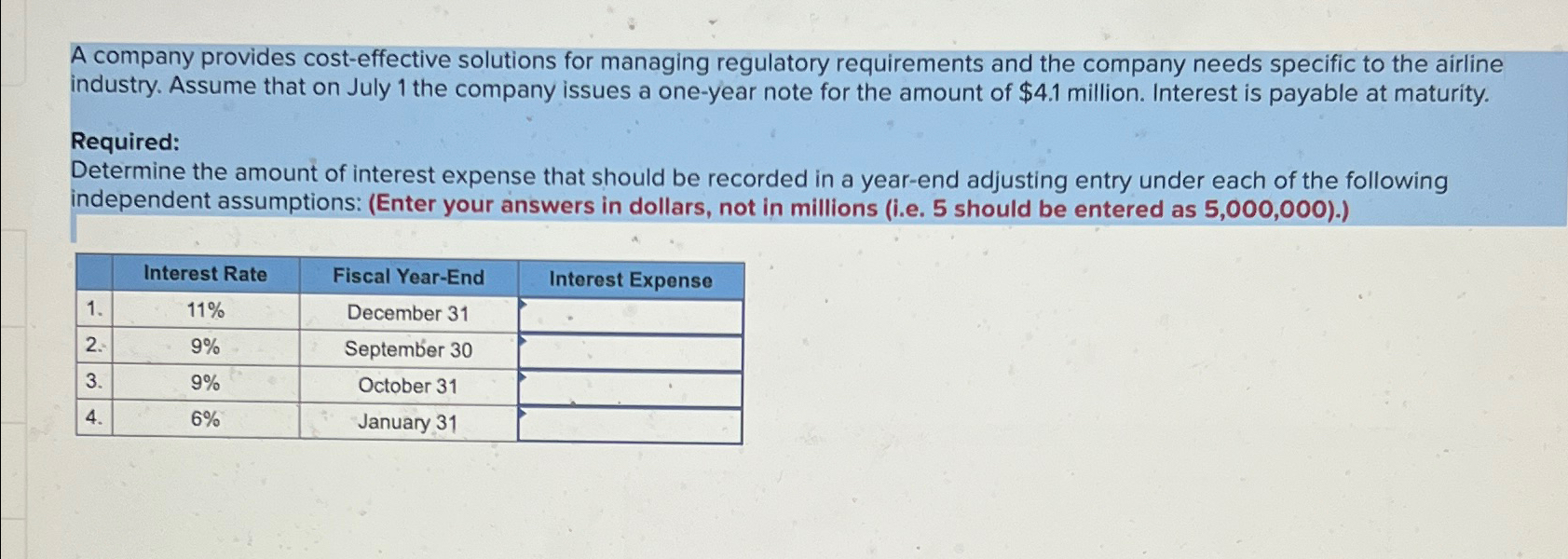

A company provides cost-effective solutions for managing regulatory requirements and the company needs specific to the airline industry. Assume that on July 1 the company issues a one-year note for the amount of $4.1 million. Interest is payable at maturity. Required: Determine the amount of interest expense that should be recorded in a year-end adjusting entry under each of the following independent assumptions: (Enter your answers in dollars, not in millions (i.e. 5 should be entered as 5,000,000).) Interest Rate Fiscal Year-End Interest Expense 1. 11% December 31 2. 9% 3. 9% September 30 October 31 4. 6% January 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Interest Rate 11 Fiscal YearEnd December 31 Note issued on July 1 for 4100000 Interest period is f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663da11db17ad_964255.pdf

180 KBs PDF File

663da11db17ad_964255.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started