Answered step by step

Verified Expert Solution

Question

1 Approved Answer

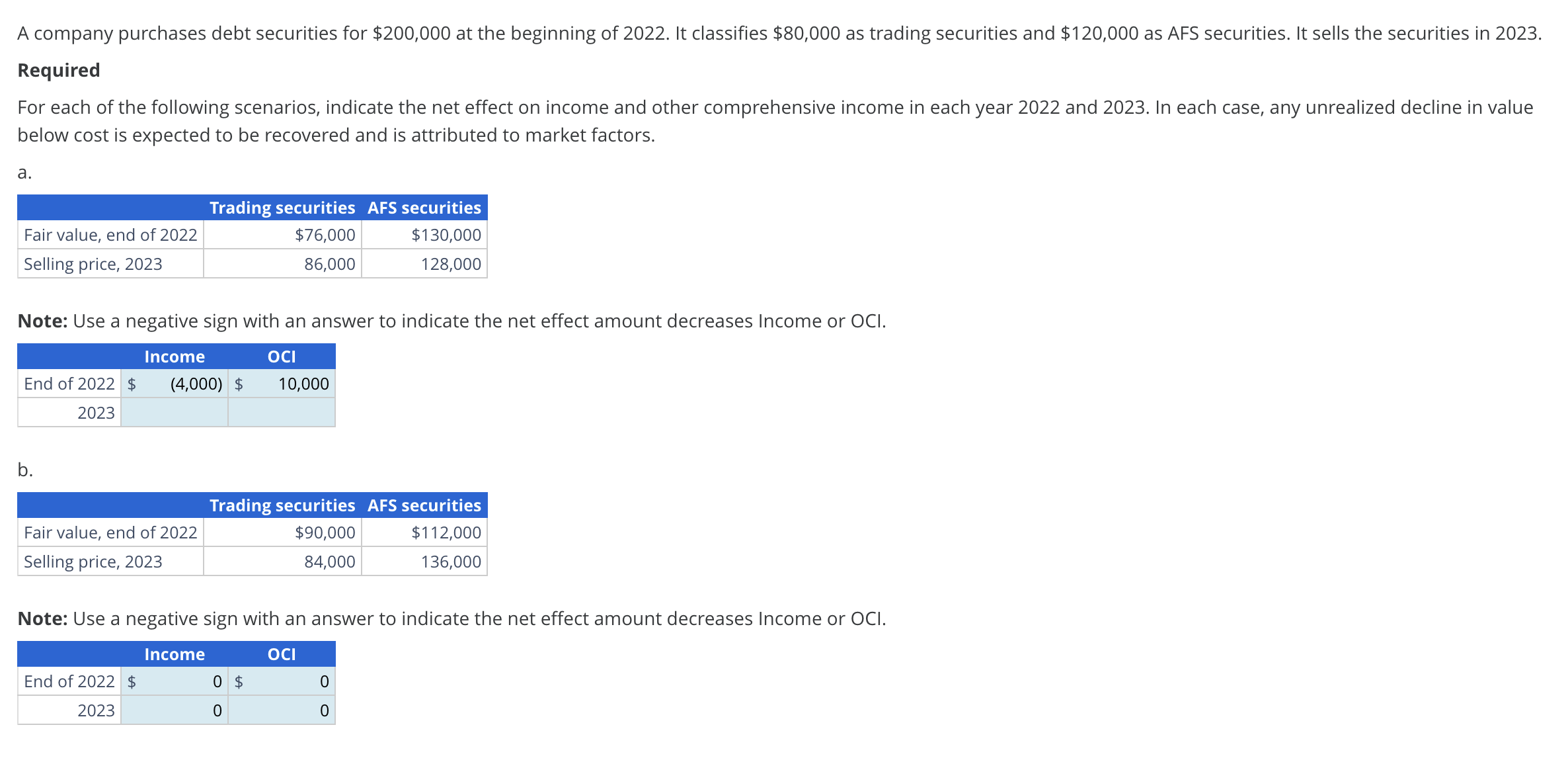

A company purchases debt securities for $ 2 0 0 , 0 0 0 at the beginning of 2 0 2 2 . It classifies

A company purchases debt securities for $ at the beginning of It classifies $ as trading securities and $ as AFS securities It sells the securities in

Required

For each of the following scenarios, indicate the net effect on income and other comprehensive income in each year and In each case, any unrealized decline in value below cost is expected to be recovered and is attributed to market factors.

a

Trading securities AFS securities

Fair value, end of $ $

Selling price,

Note: Use a negative sign with an answer to indicate the net effect amount decreases Income or OCI.

Income OCI

End of

Answer

Answer

Answer

Answer

b

Trading securities AFS securities

Fair value, end of $ $

Selling price,

Note: Use a negative sign with an answer to indicate the net effect amount decreases Income or OCI.

Income OCI

End of

Answer

Answer A company purchases debt securities for $ at the beginning of It classifies $ as trading securities and $ as AFS securities It sells the securities in

Required

For each of the following scenarios, indicate the net effect on income and other comprehensive income in each year and In each case, any unrealized decline in value

below cost is expected to be recovered and is attributed to market factors.

a

Note: Use a negative sign with an answer to indicate the net effect amount decreases Income or OCl.

b

Note: Use a negative sign with an answer to indicate the net effect amount decreases Income or OCI.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started