Answered step by step

Verified Expert Solution

Question

1 Approved Answer

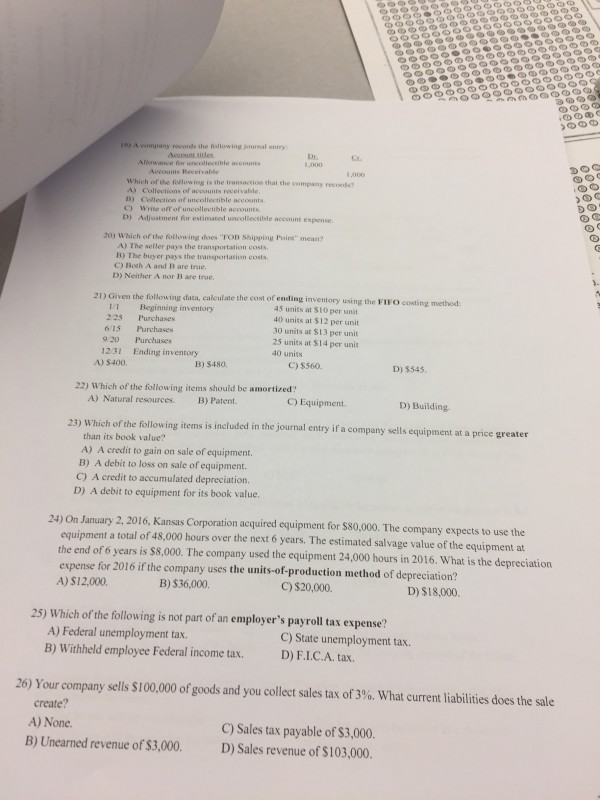

A company reconds the tollowing journal entry Secount ides Dr Which of the iolowing is the transaction that the records C Write off of uncollectible

A company reconds the tollowing journal entry Secount ides Dr Which of the iolowing is the transaction that the records C Write off of uncollectible accounts D) Adiustment for estimated uncolliectible account expense. 20) Which of the fotlow ing does TOB Shipping Poins" mean A) The seller pays the transportation costs B) The buyver pays the transportation costs C) Both A and B are true. D) Neither A nor B are true. 21) Given the following data, calculate the cost of ending inventory using the FIFO costing method 45 units at S10 per unit 40 units at $12 per unit 30 units at $13 per unit 25 units at S14 per unit 40 units 1 Beginning inventory 225 Purchases 615 Purchases 9 20 Purchases 1231 Ending inventory A) 5400. B) $480. C) $560. D) 3545 22) Which of the following items should be amortized A) Natural resources. B) Patent. C) Equipment. D) Building 23) Which of the following items is included in the journal entry if a company sells equipment at a price greater than its book value? A) A credit to gain on sale of equipment B) A debit to loss on sale of equipment. C) A credit to accumulated depreciation. D) A debit to equipment for its book value. 24) On January 2, 2016, Kansas Corporation acquired equipment for $$0,000. The company expects to use the ment a total of 48,000 hours over the next 6 years. The estimated salvage value of the equipment at the end of 6 years is $8,000. The company used the equipment 24,000 hours in 2016. What is the depreciation expense for 2016 if the company uses the units-of-production method of depreciation? A) $12,000 B) S36,000. C) $20,000. D) $ 18,000. 25) Which of the following is not part of an employer's payroll tax expense? A) Federal unemployment tax. B) Withheld employee Federal income tax. C) State unemployment tax D)FI.C.A. tax 26) Your company sells $100,000 ofgoods and you collect sales tax of 3%. What current liabilities does the sale create? A) None. C) Sales tax payable of $3,000. B) Unearned revenue of $3,000. D) Sales revenue of $103,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started