Answered step by step

Verified Expert Solution

Question

1 Approved Answer

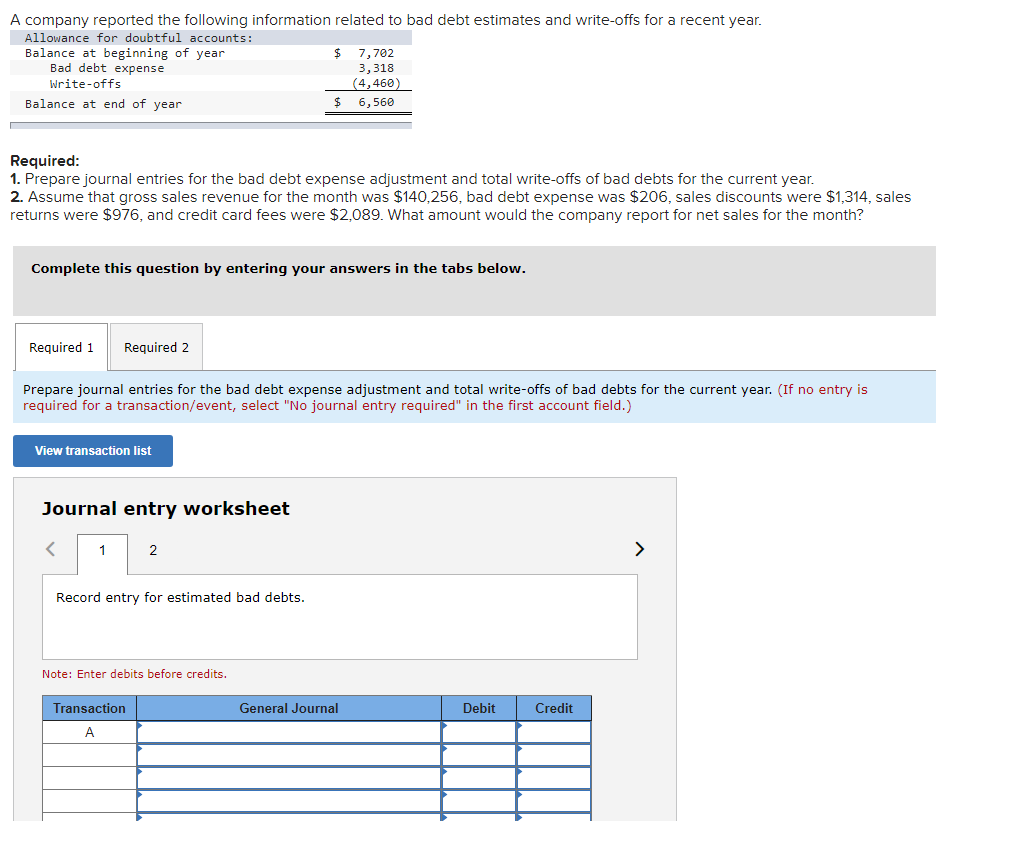

A company reported the following information related to bad debt estimates and write-offs for a recent year. Allowance for doubtful accounts: Balance at beginning of

A company reported the following information related to bad debt estimates and write-offs for a recent year.

| Allowance for doubtful accounts: | |||

| Balance at beginning of year | $ | 7,702 | |

| Bad debt expense | 3,318 | ||

| Write-offs | (4,460 | ) | |

| Balance at end of year | $ | 6,560 | |

Required:

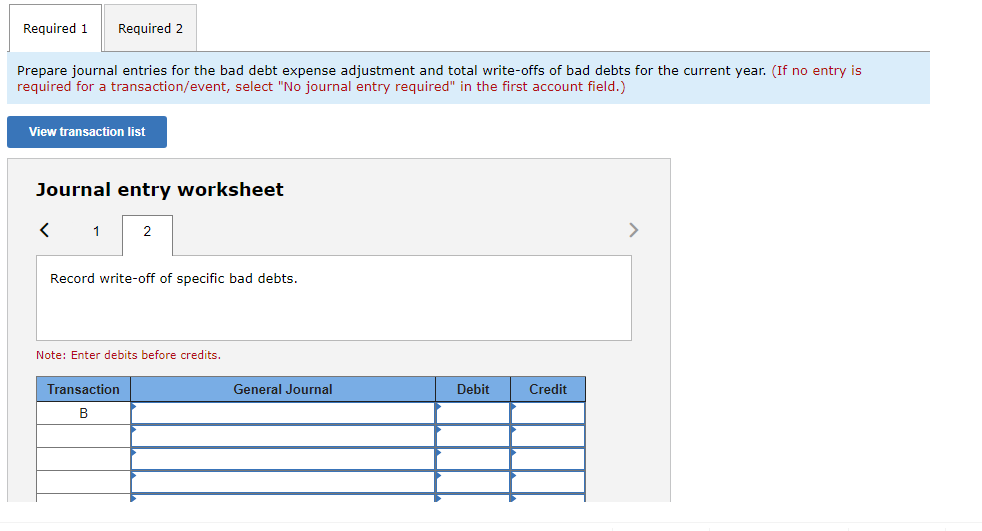

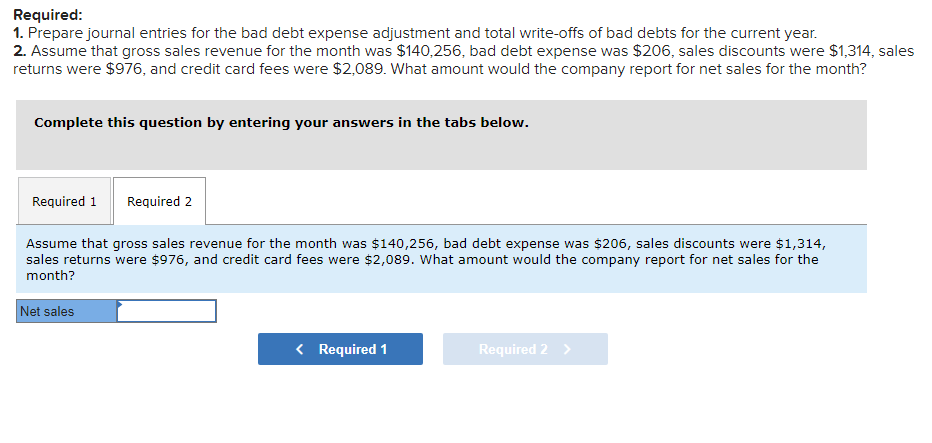

1. Prepare journal entries for the bad debt expense adjustment and total write-offs of bad debts for the current year. 2. Assume that gross sales revenue for the month was $140,256, bad debt expense was $206, sales discounts were $1,314, sales returns were $976, and credit card fees were $2,089. What amount would the company report for net sales for the month?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started