Answered step by step

Verified Expert Solution

Question

1 Approved Answer

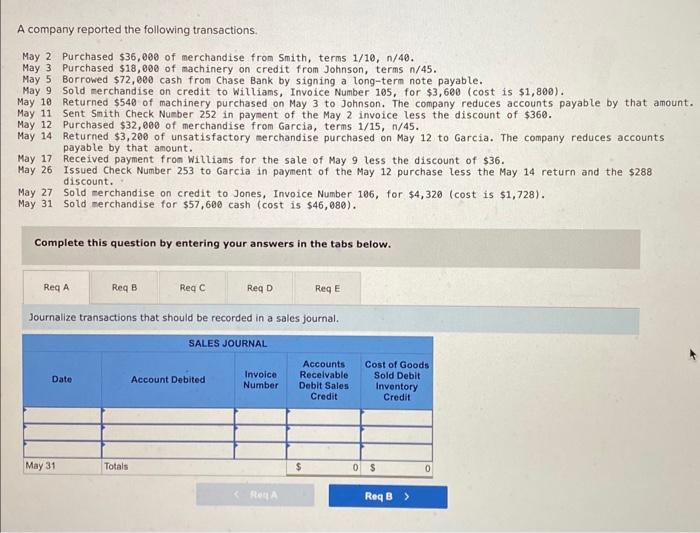

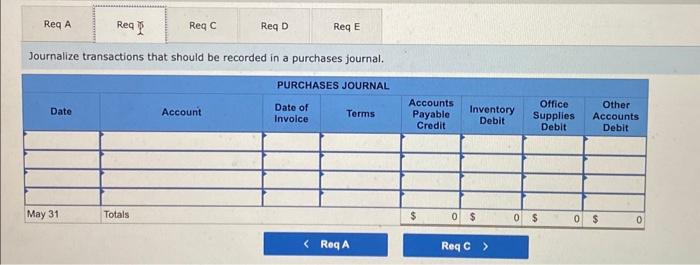

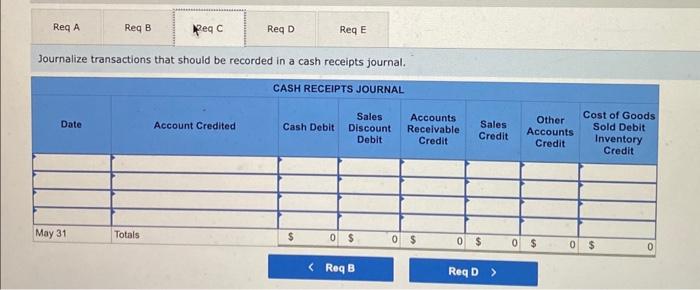

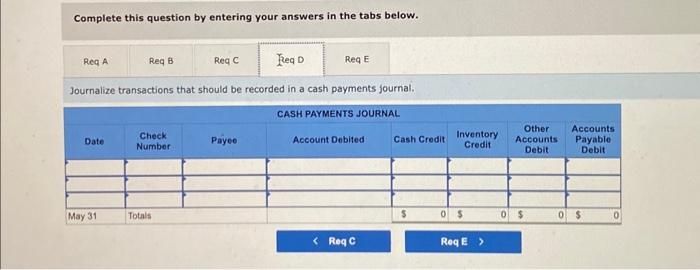

A company reported the following transactions. May 2 Purchased $36,000 of merchandise from Smith, terms 1/10, n/40. May 3 Purchased $18,000 of machinery on

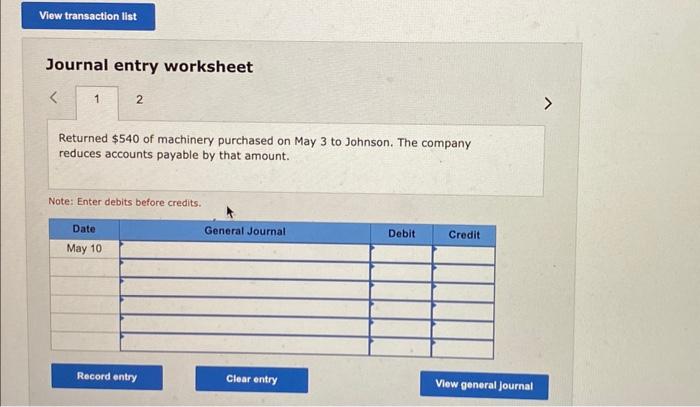

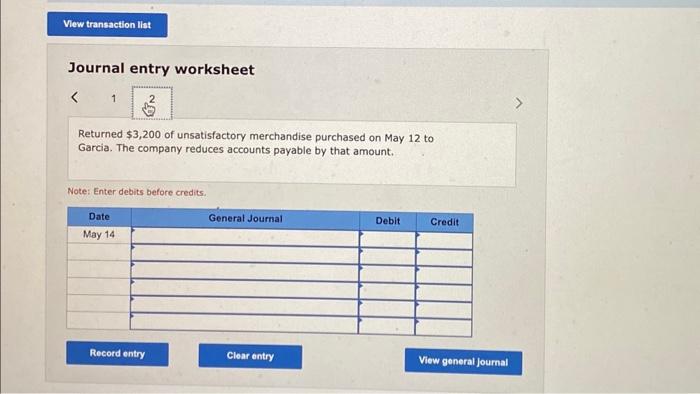

A company reported the following transactions. May 2 Purchased $36,000 of merchandise from Smith, terms 1/10, n/40. May 3 Purchased $18,000 of machinery on credit from Johnson, terms n/45. May 5 May 9 May 10 May 11 May 12 May 14 May 17 May 26 Borrowed $72,000 cash from Chase Bank by signing a long-term note payable. Sold merchandise on credit to Williams, Invoice Number 105, for $3,600 (cost is $1,800). Returned $540 of machinery purchased on May 3 to Johnson. The company reduces accounts payable by that amount. Sent Smith Check Number 252 in payment of the May 2 invoice less the discount of $360. Purchased $32,000 of merchandise from Garcia, terms 1/15, n/45. Returned $3,200 of unsatisfactory merchandise purchased on May 12 to Garcia. The company reduces accounts payable by that amount. Received payment from Williams for the sale of May 9 less the discount of $36. Issued Check Number 253 to Garcia in payment of the May 12 purchase less the May 14 return and the $288 discount. May 27 Sold merchandise on credit to Jones, Invoice Number 106, for $4,320 (cost is $1,728). May 31 Sold merchandise for $57,600 cash (cost is $46,080). Complete this question by entering your answers in the tabs below. Req A Req B Req C Req D Req E Journalize transactions that should be recorded in a sales journal. SALES JOURNAL Date Account Debited Invoice. Number Accounts Receivable Debit Sales Credit May 31 Totals Req A Cost of Goods Sold Debit Inventory Credit $ 0 $ Req B> Req A Rea Req C Req D Req E Journalize transactions that should be recorded in a purchases journal. Date PURCHASES JOURNAL Account Date of Invoice Terms Accounts Payable Credit Inventory Debit Office Supplies Accounts Debit Debit Other May 311 Totals $ 0 $ 0 $ 0 $ 0 < Req A Req C > Req A Req B Peg C Req D Req E Journalize transactions that should be recorded in a cash receipts journal. CASH RECEIPTS JOURNAL Date Account Credited Cash Debit Sales Discount. Debit Accounts Receivable Credit Sales Credit Other Accounts Credit Cost of Goods Sold Debit Inventory Credit May 31 Totals $ 0 $ 0 $ 0 $ 0 $ 0 $ 0 Complete this question by entering your answers in the tabs below. Req A Req B Req C Req D Req E Journalize transactions that should be recorded in a cash payments journal. CASH PAYMENTS JOURNAL Other Date Check Number Payee Account Debited Cash Credit Inventory Credit Accounts Debit Accounts Payable Debit May 31 Totals $ 0 $ 0 $ 0 $ 0 View transaction list Journal entry worksheet < 1 2 Returned $540 of machinery purchased on May 3 to Johnson. The company reduces accounts payable by that amount. Note: Enter debits before credits. Date May 10 General Journal Debit Credit Record entry Clear entry View general Journal View transaction list Journal entry worksheet < 1 Returned $3,200 of unsatisfactory merchandise purchased on May 12 to Garcia. The company reduces accounts payable by that amount. Note: Enter debits before credits. Date May 14 General Journal Debit Credit Record entry Clear entry View general Journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started