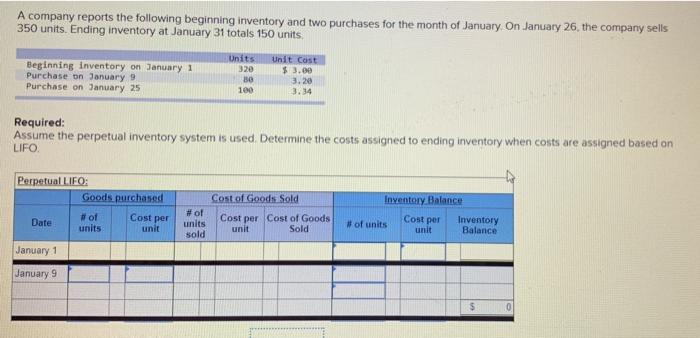

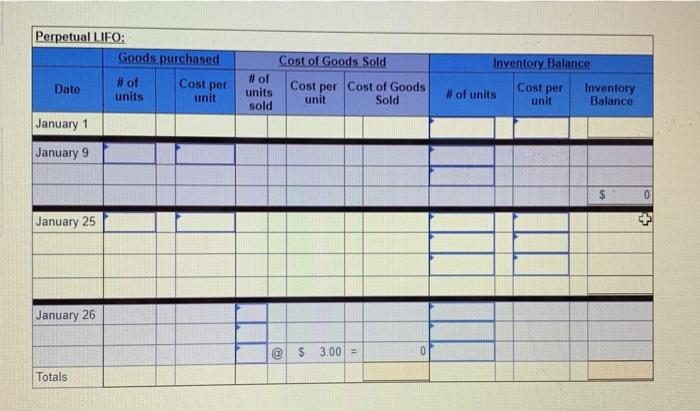

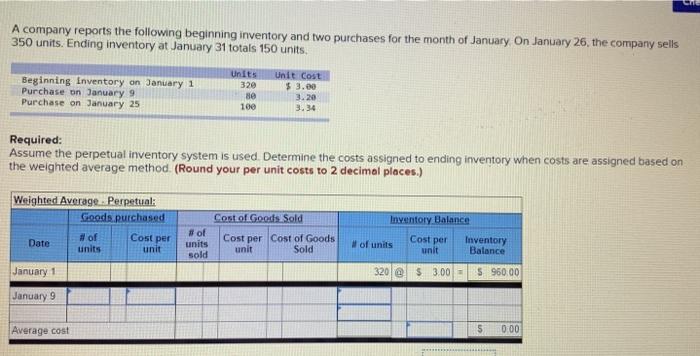

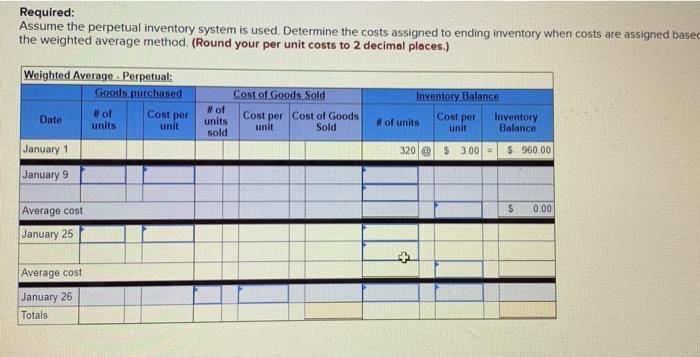

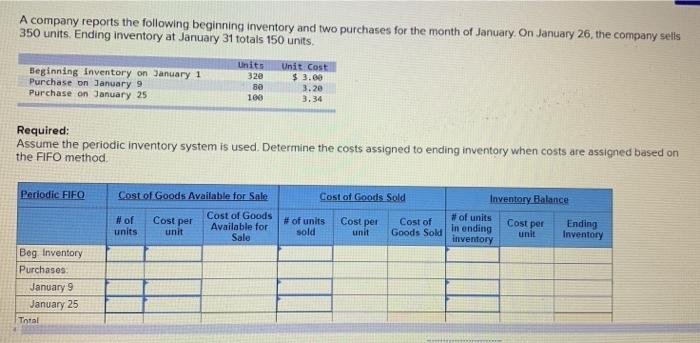

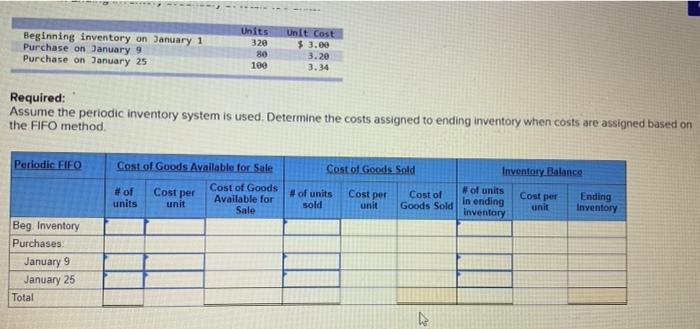

A company reports the following beginning inventory and two purchases for the month of January, On January 26, the company sells 350 units Ending inventory at January 31 totals 150 units Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 Units 320 30 100 Unit Cost $ 3.00 3.20 3.34 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on LIFO Perpetual LIFO: Goods purchased #of Date units unit Cost of Goods Sold Cost per #of units sold Cost per Cost of Goods unit Sold Inventory Balance # of units Inventory unit Balance Cost per January 1 January 9 0 Perpetual LIFO: Goods.purchased # of Date units unit Cost per Cost of Goods Sold # of Cost per Cost of Goods units unit Sold sold Inventory Balance Inventory # of units Balance Cost per unit January 1 January 9 0 January 25 + January 26 @ $ 3.00 = Totals A company reports the following beginning inventory and two purchases for the month of January On January 26, the company sells 350 units. Ending inventory at January 31 totals 150 units Beginning Inventory on January 1 Purchase on January 9 Purchase on January 25 Units 329 30 100 Unit Cost $ 3.00 3. 20 3.34 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method (Round your per unit costs to 2 decimal places.) Weighted Average Perpetual: Goods purchased Cost of Goods Sold Inventory Balance #of units Cost per Date # of units sold unit Cost per cost of Goods unit Sold of units Cost per unit Inventory Balance January 1 320 $ 3.00 $ 950.00 January 9 Average cost 5 0.00 * Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based the weighted average method (Round your per unit costs to 2 decimal places.) Weighted Average - Perpetual: Goods purchased Date # of units unit Cost per W of units sold Cost of Goods Sold Cost per Cost of Goods unit Sold Inventory Balance Inventory W of units unit Balance Cost per 320 @ $ 3.00 = $ 960 00 January 1 January 9 $ 0.00 Average cost January 25 Average cost January 26 Totals A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company selis 350 units Ending inventory at January 31 totals 150 units Beginning Inventory on January 1 Purchase on January 9 Purchase on January 25 Units 320 80 100 Unit Cost $ 3.00 3.20 3.34 Required: Assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method Periodic FIFO Cost of Goods Sold Cost of Goods Available for Sale # of Cost of Goods units unit Available for Sale Cost per # of units sold Cost per Inventory Balance #of units In ending Ending unit Inventory inventory Cost of Goods Sold Cost per unit Beg, Inventory Purchases January 9 January 25 Total Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 Units 320 80 100 Unit Cost $ 3.00 3.20 3.34 Required: Assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method Periodic FIFO Cost of Goods Sold Cost of Goods Available for Sale Cost of Goods units Available for unit Sale #of Cost per # of units sold Cost per Inventory Balance #of units in ending Ending unit inventory Inventory Cost of Goods Sold Cost per unit Beg Inventory Purchases January 9 January 25 Total A