Answered step by step

Verified Expert Solution

Question

1 Approved Answer

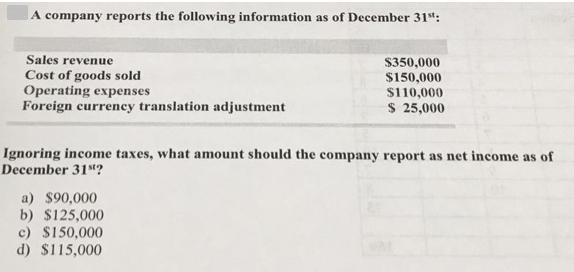

A company reports the following information as of December 31: Sales revenue Cost of goods sold Operating expenses Foreign currency translation adjustment $350,000 $150,000

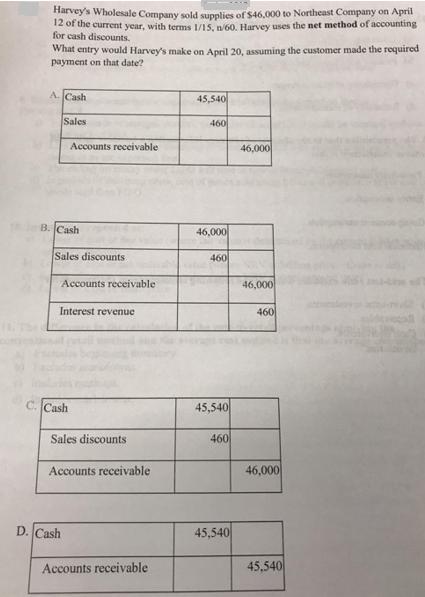

A company reports the following information as of December 31": Sales revenue Cost of goods sold Operating expenses Foreign currency translation adjustment $350,000 $150,000 $110,000 $ 25,000 Ignoring income taxes, what amount should the company report as net income as of December 31"? a) $90,000 b) $125,000 c) $150,000 d) $115,000 - Inventory is reported at: a) Lower of cost or fair value (where fair value is determined by the current market price using PV factors) b) Lower of cost or net realizable value (where NRV is Selling price - Costs to sell) c) Lower of cost or net realizable value (where NRV is Replacement cost) d) Lower of Cost or retail price Harvey's Wholesale Company sold supplies of $46,000 to Northeast Company on April 12 of the current year, with terms 1/15, n/60, Harvey uses the net method of accounting for cash discounts. What entry would Harvey's make on April 20, assuming the customer made the required payment on that date? A.Cash 45,540 Sales 460 Accounts receivable 46,000 B. Cash 46,000 Sales discounts 460 Accounts receivable 46,000 Interest revenue 460 C. Cash 45,540 Sales discounts 460 Accounts receivable 46,000 D. Cash 45,540 Accounts receivable 45,540 A company reports the following information as of December 31": Sales revenue Cost of goods sold Operating expenses Foreign currency translation adjustment $350,000 $150,000 $110,000 $ 25,000 Ignoring income taxes, what amount should the company report as net income as of December 31"? a) $90,000 b) $125,000 c) $150,000 d) $115,000 - Inventory is reported at: a) Lower of cost or fair value (where fair value is determined by the current market price using PV factors) b) Lower of cost or net realizable value (where NRV is Selling price - Costs to sell) c) Lower of cost or net realizable value (where NRV is Replacement cost) d) Lower of Cost or retail price Harvey's Wholesale Company sold supplies of $46,000 to Northeast Company on April 12 of the current year, with terms 1/15, n/60, Harvey uses the net method of accounting for cash discounts. What entry would Harvey's make on April 20, assuming the customer made the required payment on that date? A.Cash 45,540 Sales 460 Accounts receivable 46,000 B. Cash 46,000 Sales discounts 460 Accounts receivable 46,000 Interest revenue 460 C. Cash 45,540 Sales discounts 460 Accounts receivable 46,000 D. Cash 45,540 Accounts receivable 45,540 A company reports the following information as of December 31": Sales revenue Cost of goods sold Operating expenses Foreign currency translation adjustment $350,000 $150,000 $110,000 $ 25,000 Ignoring income taxes, what amount should the company report as net income as of December 31"? a) $90,000 b) $125,000 c) $150,000 d) $115,000 - Inventory is reported at: a) Lower of cost or fair value (where fair value is determined by the current market price using PV factors) b) Lower of cost or net realizable value (where NRV is Selling price - Costs to sell) c) Lower of cost or net realizable value (where NRV is Replacement cost) d) Lower of Cost or retail price Harvey's Wholesale Company sold supplies of $46,000 to Northeast Company on April 12 of the current year, with terms 1/15, n/60, Harvey uses the net method of accounting for cash discounts. What entry would Harvey's make on April 20, assuming the customer made the required payment on that date? A.Cash 45,540 Sales 460 Accounts receivable 46,000 B. Cash 46,000 Sales discounts 460 Accounts receivable 46,000 Interest revenue 460 C. Cash 45,540 Sales discounts 460 Accounts receivable 46,000 D. Cash 45,540 Accounts receivable 45,540

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Income statement for ending 31Dec Sales revenue 350000 Less Cost of goods sol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started