Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company requires the services of a forklift for the next 10 years and is considering the following options: Option A: Purchase a new

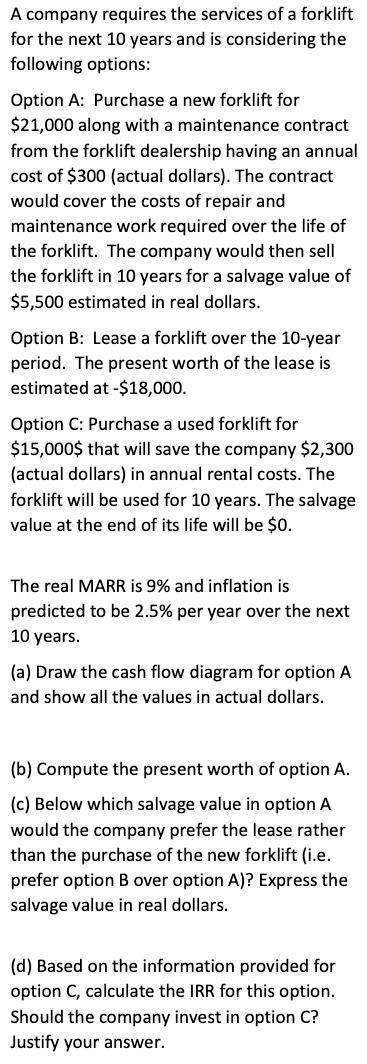

A company requires the services of a forklift for the next 10 years and is considering the following options: Option A: Purchase a new forklift for $21,000 along with a maintenance contract from the forklift dealership having an annual cost of $300 (actual dollars). The contract would cover the costs of repair and maintenance work required over the life of the forklift. The company would then sell the forklift in 10 years for a salvage value of $5,500 estimated in real dollars. Option B: Lease a forklift over the 10-year period. The present worth of the lease is estimated at -$18,000. Option C: Purchase a used forklift for $15,000$ that will save the company $2,300 (actual dollars) in annual rental costs. The forklift will be used for 10 years. The salvage value at the end of its life will be $0. The real MARR is 9% and inflation is predicted to be 2.5% per year over the next 10 years. (a) Draw the cash flow diagram for option A and show all the values in actual dollars. (b) Compute the present worth of option A. (c) Below which salvage value in option A would the company prefer the lease rather than the purchase of the new forklift (i.e. prefer option B over option A)? Express the salvage value in real dollars. (d) Based on the information provided for option C, calculate the IRR for this option. Should the company invest in option C? Justify your answer.

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Cash Flow for Option A Year 0 21000 Purchase of new forklift Year 1 300 Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started