Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company selected the fair value option to record its bond liabilities. In 2019, the company has an outstanding bond with a carrying value

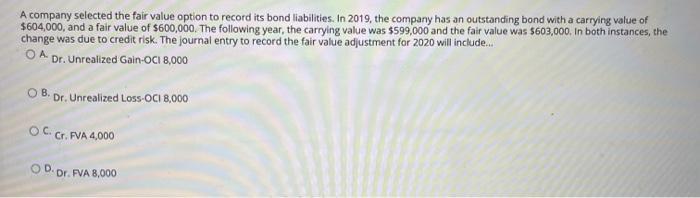

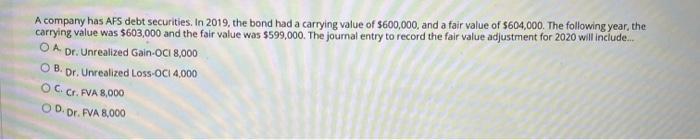

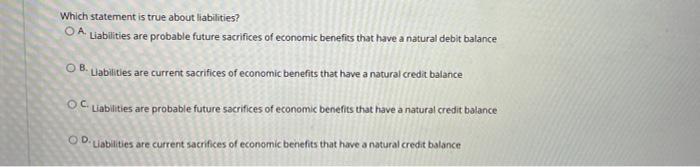

A company selected the fair value option to record its bond liabilities. In 2019, the company has an outstanding bond with a carrying value of $604,000, and a fair value of $600,000. The following year, the carrying value was $599,000 and the fair value was $603,000. In both instances, the change was due to credit risk. The journal entry to record the fair value adjustment for 2020 will include... OA Dr. Unrealized Gain-OCI 8,000 OB. Dr. Unrealized Loss-OCI 8,000 OC. Cr. FVA 4,000 OD. Dr. FVA 8,000 A company has AFS debt securities. In 2019, the bond had a carrying value of $600,000, and a fair value of $604,000. The following year, the carrying value was $603,000 and the fair value was $599,000. The journal entry to record the fair value adjustment for 2020 will include..... OA Dr. Unrealized Gain-OCI 8,000 OB. Dr. Unrealized Loss-OCI 4,000 OC. Cr. FVA 8,000 OD. Dr. FVA 8,000 Which statement is true about liabilities? OA Liabilities are probable future sacrifices of economic benefits that have a natural debit balance OB. Liabilities are current sacrifices of economic benefits that have a natural credit balance OC Liabilities are probable future sacrifices of economic benefits that have a natural credit balance OD Liabilities are current sacrifices of economic benefits that have a natural credit balance

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

1 In 2019 the carrying value 600000 Fair value 604000 It means fair value adjuatment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started