Answered step by step

Verified Expert Solution

Question

1 Approved Answer

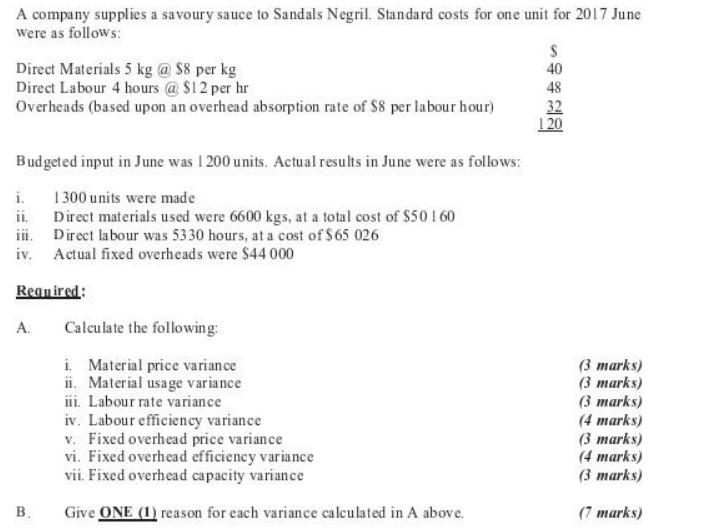

A company supplies a savoury sauce to Sandals Negril. Standard costs for one unit for 2017 June were as follows: Direct Materials 5 kg

A company supplies a savoury sauce to Sandals Negril. Standard costs for one unit for 2017 June were as follows: Direct Materials 5 kg @ $8 per kg Direct Labour 4 hours @ $12 per hr Overheads (based upon an overhead absorption rate of $8 per labour hour) Budgeted input in June was 1 200 units. Actual results in June were as follows: 1300 units were made Direct materials used were 6600 kgs, at a total cost of $50160 Direct labour was 5330 hours, at a cost of $65 026 iv. Actual fixed overheads were $44 000 iii. i. Required: A. B. Calculate the following: i. Material price variance ii. Material usage variance iii. Labour rate variance iv. Labour efficiency variance v. Fixed overhead price variance vi. Fixed overhead efficiency variance vii. Fixed overhead capacity variance Give ONE (1) reason for each variance calculated in A above. $ 40 48 32 120 (3 marks) (3 marks) (3 marks) (4 marks) (3 marks) (4 marks) (3 marks) (7 marks)

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION A Calculation of Variances 1 Material Price Variance Material Price Variance Actual Quantity Purchased ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started