Answered step by step

Verified Expert Solution

Question

1 Approved Answer

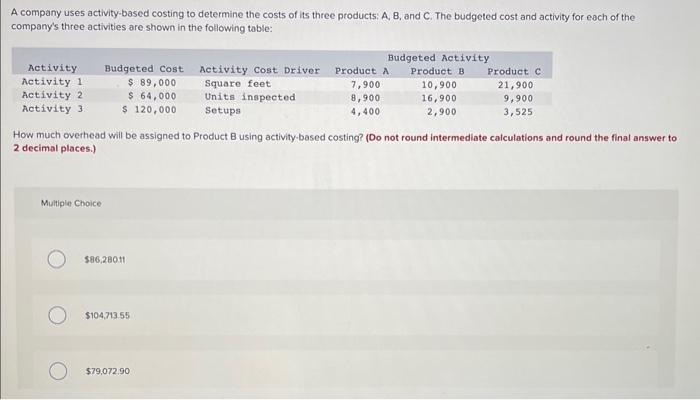

A company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each

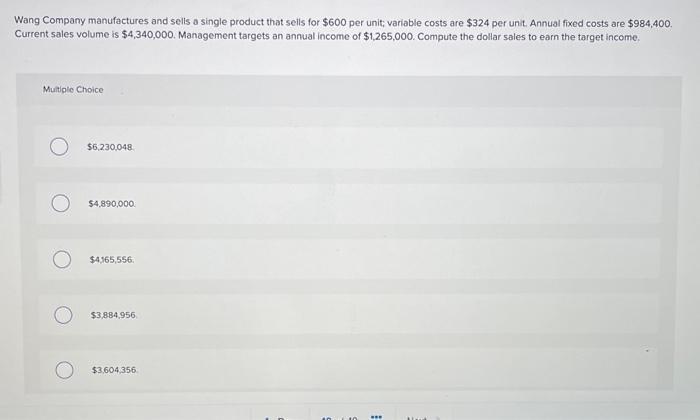

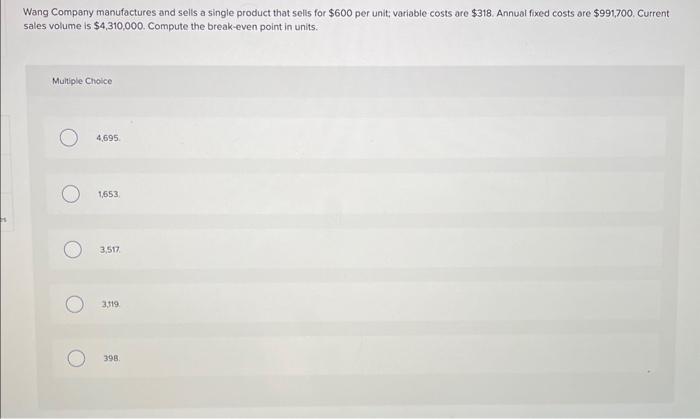

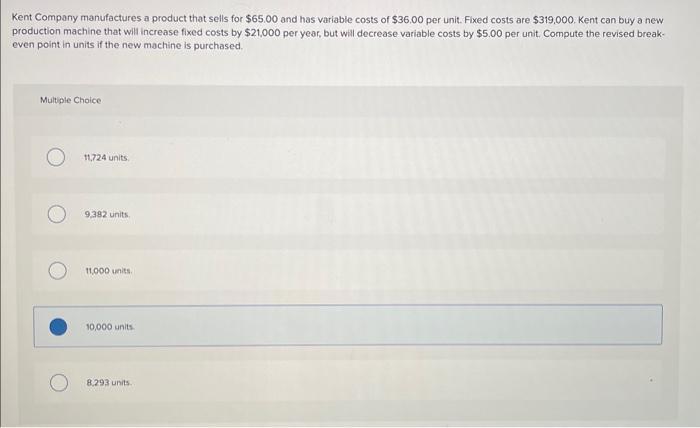

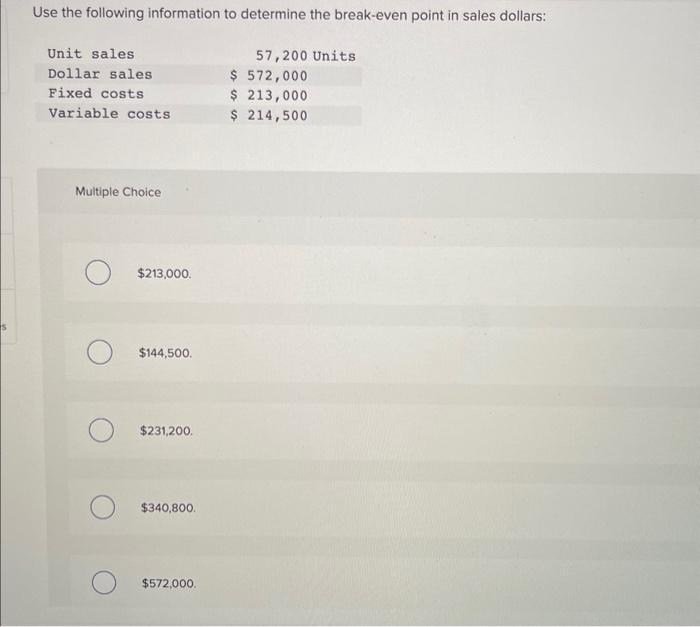

A company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each of the company's three activities are shown in the following table: Activity Activity 1 Activity 2 Activity 3 Budgeted Cost $ 89,000 Multiple Choice $ 64,000 $ 120,000 $86,280.11 $104,713.55 Activity Cost Driver Square feet Units inspected Setups How much overhead will be assigned to Product B using activity-based costing? (Do not round intermediate calculations and round the final answer to 2 decimal places.) $79,072.90 Budgeted Activity Product A 7,900 8,900 4,400 Product B Product C 10,900 21,900 16,900 9,900 2,900 3,525 Wang Company manufactures and sells a single product that sells for $600 per unit; variable costs are $324 per unit. Annual fixed costs are $984,400. Current sales volume is $4,340,000. Management targets an annual income of $1,265,000. Compute the dollar sales to earn the target income. Multiple Choice $6,230,048 $4,890,000 $4,165,556 $3,884,956 $3,604,356 10 10 *** Wang Company manufactures and sells a single product that sells for $600 per unit; variable costs are $318. Annual fixed costs are $991,700. Current sales volume is $4,310,000. Compute the break-even point in units. Multiple Choice 4,695. 1,653 3,517 3,319 398 Kent Company manufactures a product that sells for $65.00 and has variable costs of $36.00 per unit. Fixed costs are $319,000. Kent can buy a new production machine that will increase fixed costs by $21,000 per year, but will decrease variable costs by $5.00 per unit. Compute the revised break- even point in units if the new machine is purchased. Multiple Choice 11,724 units. 9,382 units, 11,000 units. 10,000 units 8,293 units. S Use the following information to determine the break-even point in sales dollars: Unit sales Dollar sales Fixed costs Variable costs Multiple Choice O $213,000. O $144,500. $231,200. O $340,800. $572,000. 57,200 Units $ 572,000 $ 213,000 $ 214,500

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer Overhead applied on product B 8628011 or 86280depending ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started