Question

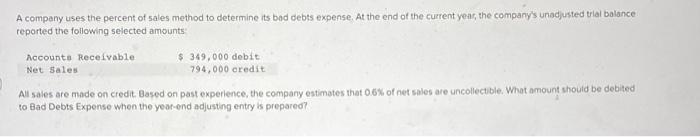

A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted

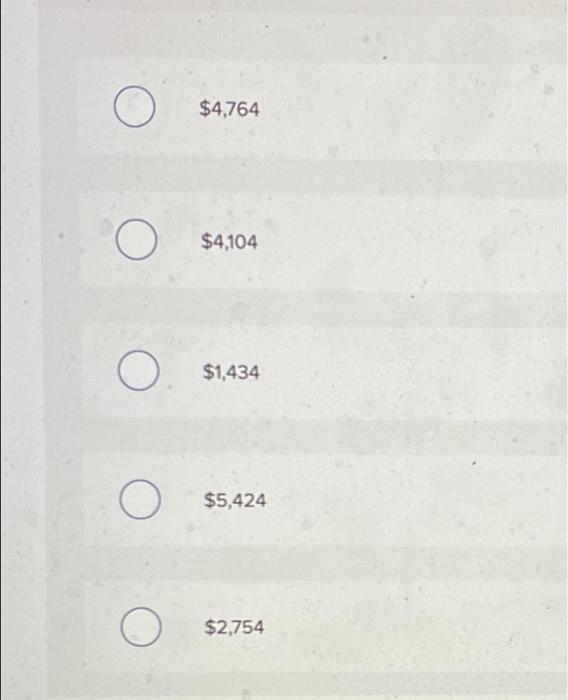

A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts 349,000 debit 794,000 credit Accounte Receivable Net Sales All sales are made on credit. Based on past experience, the company estimates that 0.6% of net sales are uncollectible. What amount should be debited to Bad Debts Expense when the year-end adjusting entry is prepared? $4,764 $4,104 $1,434 $5,424 $2,754

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Ans To Calculate Bad debt expense Given Net sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Carl warren, James Reeve, Jonathen Duchac, Sheila Elworthy,

Volume 1, 2nd canadian Edition

176509739, 978-0176509736, 978-0176509743

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App