Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company wanting to build a hotel in downtown St. John's needs to buy two properties. The appraised values for Properties 1 and 2 are

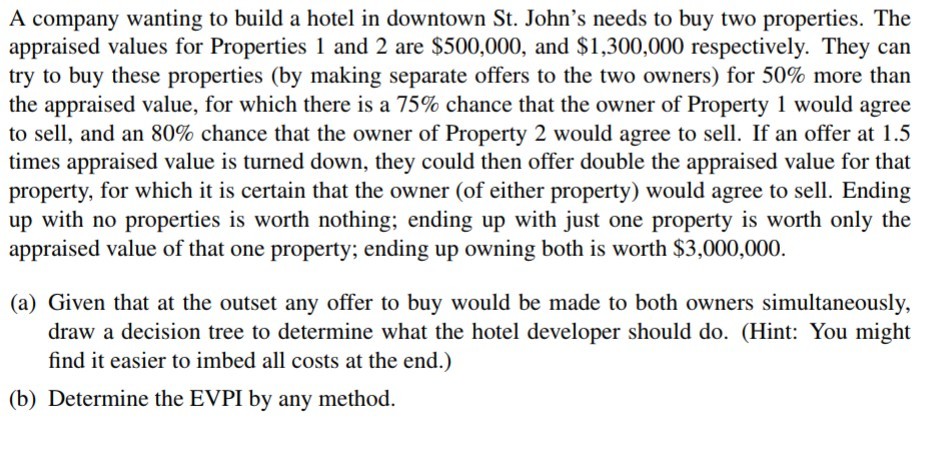

A company wanting to build a hotel in downtown St. John's needs to buy two properties. The appraised values for Properties 1 and 2 are $500,000, and $1,300,000 respectively. They can try to buy these properties (by making separate offers to the two owners) for 50% more than the appraised value, for which there is a 75% chance that the owner of Property i would agree to sell, and an 80% chance that the owner of Property 2 would agree to sell. If an offer at 1.5 times appraised value is turned down, they could then offer double the appraised value for that property, for which it is certain that the owner (of either property) would agree to sell. Ending up with no properties is worth nothing; ending up with just one property is worth only the appraised value of that one property; ending up owning both is worth $3,000,000. (a) Given that at the outset any offer to buy would be made to both owners simultaneously, draw a decision tree to determine what the hotel developer should do. (Hint: You might find it easier to imbed all costs at the end.) (b) Determine the EVPI by any method. A company wanting to build a hotel in downtown St. John's needs to buy two properties. The appraised values for Properties 1 and 2 are $500,000, and $1,300,000 respectively. They can try to buy these properties (by making separate offers to the two owners) for 50% more than the appraised value, for which there is a 75% chance that the owner of Property i would agree to sell, and an 80% chance that the owner of Property 2 would agree to sell. If an offer at 1.5 times appraised value is turned down, they could then offer double the appraised value for that property, for which it is certain that the owner (of either property) would agree to sell. Ending up with no properties is worth nothing; ending up with just one property is worth only the appraised value of that one property; ending up owning both is worth $3,000,000. (a) Given that at the outset any offer to buy would be made to both owners simultaneously, draw a decision tree to determine what the hotel developer should do. (Hint: You might find it easier to imbed all costs at the end.) (b) Determine the EVPI by any method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started