Question

A company wants to invest in a business with the following assets. The investment is done in 2 different phases: The initial investment of phase

A company wants to invest in a business with the following assets. The investment is done in 2 different phases: The initial investment of phase 1 (year 0) is $1,150,000, which is divided in the following form.

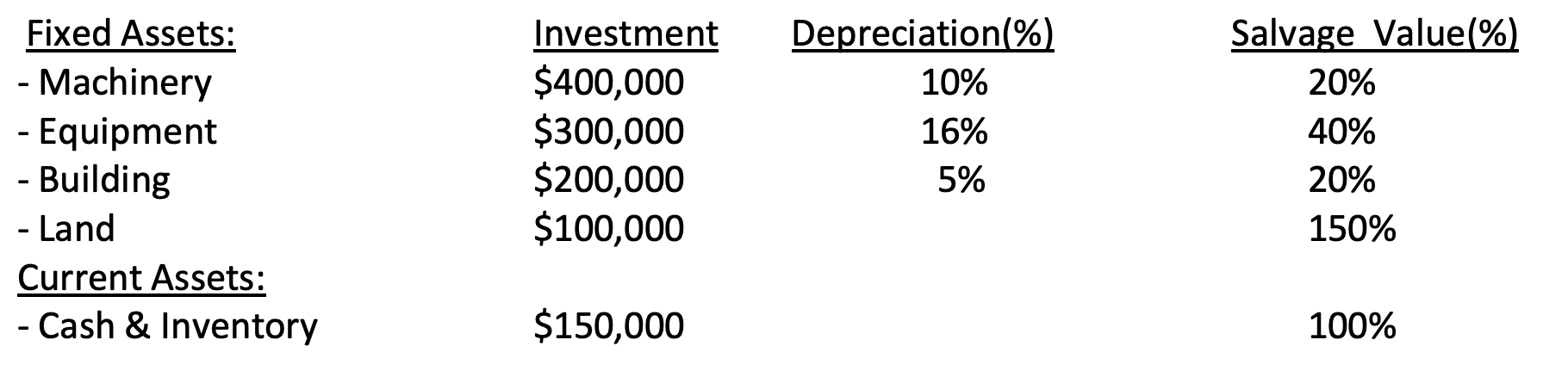

Fixed Assets: Investment Depreciation(%) Salvage Value(%) - Machinery $400,000 10% 20% - Equipment $300,000 16% 40% - Building $200,000 5% 20% - Land $100,000 150% Current Assets: - Cash & Inventory $150,000 100% The net incomes are $500,000/year for the first 2 years and $600,000/year for the last 4 years. The company would have an additional investment (phase 2) at the end of 2nd year, purchasing another machinery for $200,000 (depreciated at a rate of 35% per year) and an additional cash for $75,000. The salvage value of these new investments will be 30% of F. Asset and 100% of C. Asset. With a total project life of 6 years and tax rate of 35%, prepare the information (table) for the before and after the tax cash flow and calculate the IRR for the after the tax cash flow.

- Fixed Assets: - Machinery - Equipment - Building - Land Current Assets: - Cash & Inventory Investment $400,000 $300,000 $200,000 $100,000 Depreciation(%) 10% 16% 5% - Salvage Value(%) 20% 40% 20% 150% - $150,000 100%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started