Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Company, which has income of $11,250 and an invested capital of $75,000, is studying an investment opportunity that will cost $35,000 and yield

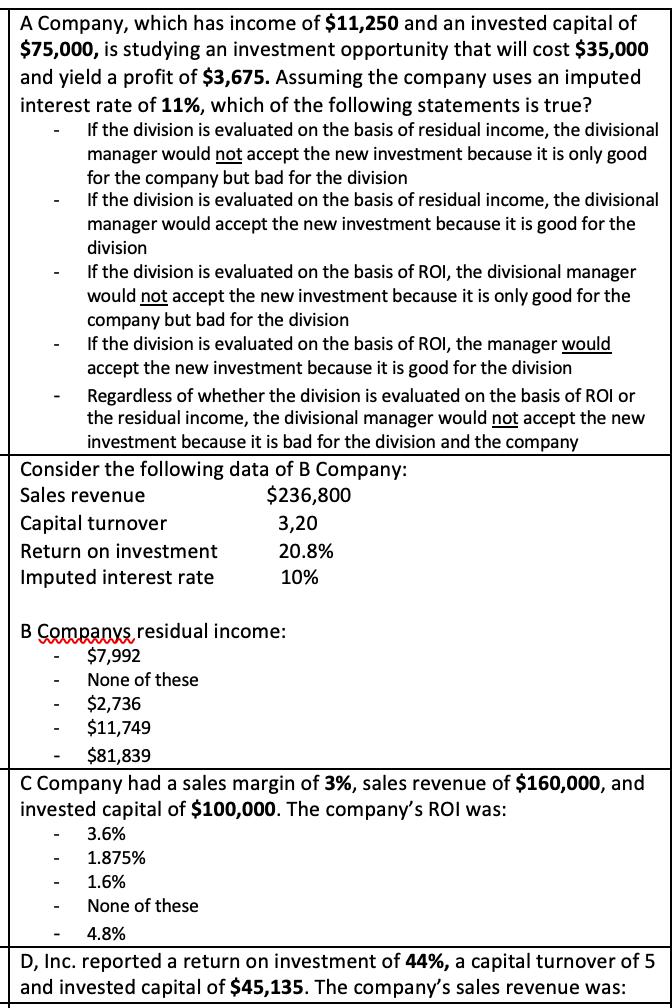

A Company, which has income of $11,250 and an invested capital of $75,000, is studying an investment opportunity that will cost $35,000 and yield a profit of $3,675. Assuming the company uses an imputed interest rate of 11%, which of the following statements is true? If the division is evaluated on the basis of residual income, the divisional manager would not accept the new investment because it is only good for the company but bad for the division If the division is evaluated on the basis of residual income, the divisional manager would accept the new investment because it is good for the division If the division is evaluated on the basis of ROI, the divisional manager would not accept the new investment because it is only good for the company but bad for the division If the division is evaluated on the basis of ROI, the manager would accept the new investment because it is good for the division Regardless of whether the division is evaluated on the basis of ROI or the residual income, the divisional manager would not accept the new investment because it is bad for the division and the company Consider the following data of B Company: Sales revenue $236,800 Capital turnover 3,20 Return on investment 20.8% Imputed interest rate 10% B Companys residual income: $7,992 None of these $2,736 $11,749 $81,839 C Company had a sales margin of 3%, sales revenue of $160,000, and invested capital of $100,000. The company's ROI was: 3.6% 1.875% 1.6% None of these 4.8% D, Inc. reported a return on investment of 44%, a capital turnover of 5 and invested capital of $45,135. The company's sales revenue was:

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer is Regardless of whether the division is evaluated on the basis of ROI or Residual income the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started