Answered step by step

Verified Expert Solution

Question

1 Approved Answer

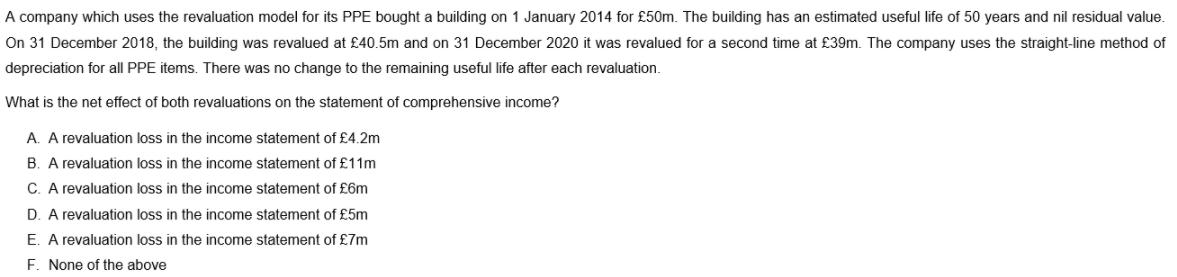

A company which uses the revaluation model for its PPE bought a building on 1 January 2014 for 50m. The building has an estimated

A company which uses the revaluation model for its PPE bought a building on 1 January 2014 for 50m. The building has an estimated useful life of 50 years and nil residual value. On 31 December 2018, the building was revalued at 40.5m and on 31 December 2020 it was revalued for a second time at 39m. The company uses the straight-line method of depreciation for all PPE items. There was no change to the remaining useful life after each revaluation. What is the net effect of both revaluations on the statement of comprehensive income? A. A revaluation loss in the income statement of 4.2m B. A revaluation loss in the income statement of 11m C. A revaluation loss in the income statement of 6m D. A revaluation loss in the income statement of 5m E. A revaluation loss in the income statement of 7m F. None of the above

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Amount of Depreciahion Cost of Aset Residual Valve ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started