Answered step by step

Verified Expert Solution

Question

1 Approved Answer

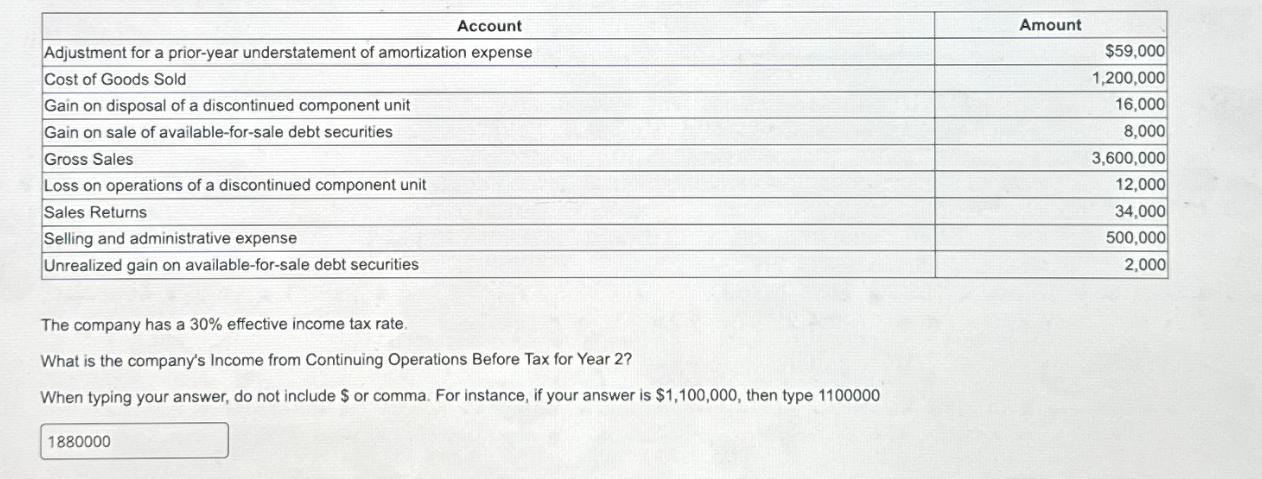

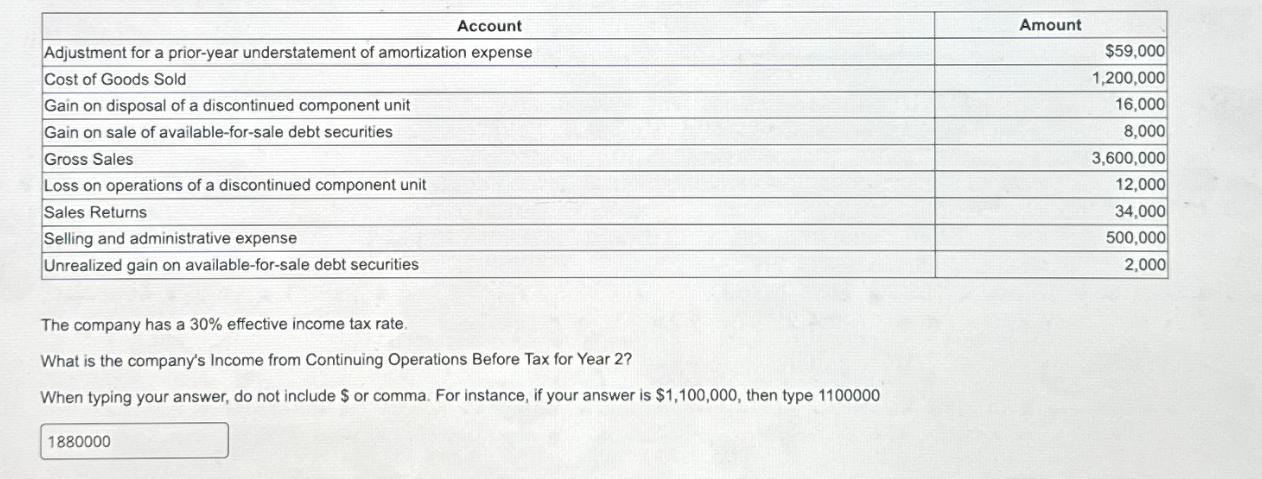

A company's activities for year 2 included the following: Account Adjustment for a prior-year understatement of amortization expense Cost of Goods Sold Gain on disposal

A company's activities for year 2 included the following:

Account Adjustment for a prior-year understatement of amortization expense Cost of Goods Sold Gain on disposal of a discontinued component unit Gain on sale of available-for-sale debt securities Gross Sales Amount $59,000 1,200,000 16,000 8,000 3,600,000 Loss on operations of a discontinued component unit Sales Returns Selling and administrative expense Unrealized gain on available-for-sale debt securities The company has a 30% effective income tax rate. What is the company's Income from Continuing Operations Before Tax for Year 2? When typing your answer, do not include $ or comma. For instance, if your answer is $1,100,000, then type 1100000 1880000 12,000 34,000 500,000 2,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the companys Income from Continuing Ope...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started