Answered step by step

Verified Expert Solution

Question

1 Approved Answer

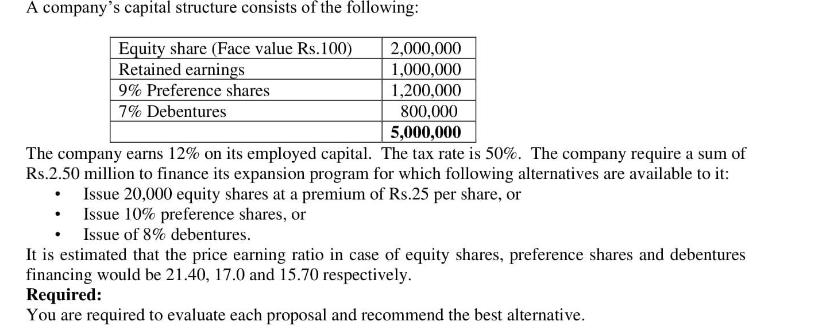

A company's capital structure consists of the following: Equity share (Face value Rs.100) Retained earnings 2,000,000 1,000,000 1,200,000 800,000 5,000,000 The company earns 12%

A company's capital structure consists of the following: Equity share (Face value Rs.100) Retained earnings 2,000,000 1,000,000 1,200,000 800,000 5,000,000 The company earns 12% on its employed capital. The tax rate is 50%. The company require a sum of Rs.2.50 million to finance its expansion program for which following alternatives are available to it: Issue 20,000 equity shares at a premium of Rs.25 per share, or Issue 10% preference shares, or 9% Preference shares 7% Debentures Issue of 8% debentures. It is estimated that the price earning ratio in case of equity shares, preference shares and debentures financing would be 21.40, 17.0 and 15.70 respectively. Required: You are required to evaluate each proposal and recommend the best alternative.

Step by Step Solution

★★★★★

3.40 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate each proposal and recommend the best alternative for financing the companys expansion program we need to calculate the cost of each option ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started