Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Complete the following Amortization Schedule. Click here to download the excel file , complete the file, save the file on your computer, upload the

a) Complete the following Amortization Schedule. Click here to download the excel file, complete the file, save the file on your computer, upload the saved file in the drop box below.

b) Prepare all necessary journal entries in the consolidated workpapers at 12/31/X8. Hint - there are 9.

1. Eliminate Income from Sub

2. Create NCI share

3. Eliminate BOY balances

4. Assign 1/1/X8 unamortized differences

5 & 6. Record amortizations

7 9. Eliminate intercompany transactions

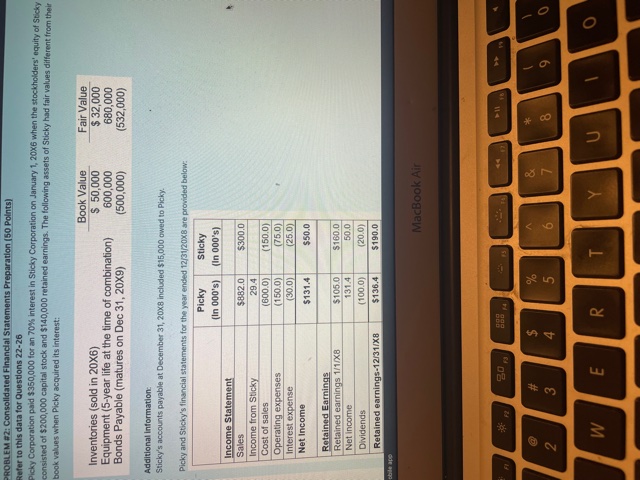

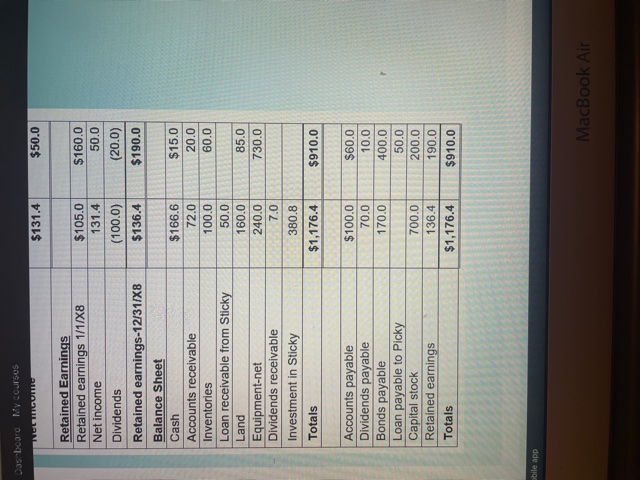

PROBLEM =2: Consolldated Financlal Statements Preparation (50 Polnts) Refer to this data for Questions 22-26 Picky Corporation paid $350,000 for an 70\% interest in Sticky Corporation on January 1,20X6 when the stockholders' equity of Sticky consisted of $200,000 capital stock and $140,000 retained earnings. The following assets of Sticky had fair values different from their book values when Picky acquired its interest: Additional information: Sticky's accounts payable at December 31,20x8 included \$15,000 owed to Picky. Picky and Sticky's tinancial statements for the year ended 12/31/20X8 are provided below: Dosubeare MV courses \begin{tabular}{|l|r|r|} \hline Retained Earnings & $131.4 & $50.0 \\ \hline Retained earnings 1/1/X8 & & \\ \hline Net income & 131.4 & 50.0 \\ \hline Dividends & (100.0) & (20.0) \\ \hline Retained earnings-12/31/X8 & $136.4 & $190.0 \\ \hline Balance Sheet & & \\ \hline Cash & $166.6 & $15.0 \\ \hline Accounts receivable & 72.0 & 20.0 \\ \hline Inventories & 100.0 & 60.0 \\ \hline Loan receivable from Sticky & 50.0 & \\ \hline Land & 160.0 & 85.0 \\ \hline Equipment-net & 240.0 & 730.0 \\ \hline Dividends receivable & 7.0 & \\ \hline Investment in Sticky & 380.8 & \\ \hline Totals & $1,176.4 & $910.0 \\ \hline & & \\ \hline Accounts payable & $100.0 & $60.0 \\ \hline Dividends payable & 70.0 & 10.0 \\ \hline Bonds payable & 170.0 & 400.0 \\ \hline Loan payable to Picky & & 50.0 \\ \hline Capital stock & 136.4 & 190.0 \\ \hline Retained earnings & & \\ \hline Totals & $910.0 \\ \hline \end{tabular} PROBLEM =2: Consolldated Financlal Statements Preparation (50 Polnts) Refer to this data for Questions 22-26 Picky Corporation paid $350,000 for an 70\% interest in Sticky Corporation on January 1,20X6 when the stockholders' equity of Sticky consisted of $200,000 capital stock and $140,000 retained earnings. The following assets of Sticky had fair values different from their book values when Picky acquired its interest: Additional information: Sticky's accounts payable at December 31,20x8 included \$15,000 owed to Picky. Picky and Sticky's tinancial statements for the year ended 12/31/20X8 are provided below: Dosubeare MV courses \begin{tabular}{|l|r|r|} \hline Retained Earnings & $131.4 & $50.0 \\ \hline Retained earnings 1/1/X8 & & \\ \hline Net income & 131.4 & 50.0 \\ \hline Dividends & (100.0) & (20.0) \\ \hline Retained earnings-12/31/X8 & $136.4 & $190.0 \\ \hline Balance Sheet & & \\ \hline Cash & $166.6 & $15.0 \\ \hline Accounts receivable & 72.0 & 20.0 \\ \hline Inventories & 100.0 & 60.0 \\ \hline Loan receivable from Sticky & 50.0 & \\ \hline Land & 160.0 & 85.0 \\ \hline Equipment-net & 240.0 & 730.0 \\ \hline Dividends receivable & 7.0 & \\ \hline Investment in Sticky & 380.8 & \\ \hline Totals & $1,176.4 & $910.0 \\ \hline & & \\ \hline Accounts payable & $100.0 & $60.0 \\ \hline Dividends payable & 70.0 & 10.0 \\ \hline Bonds payable & 170.0 & 400.0 \\ \hline Loan payable to Picky & & 50.0 \\ \hline Capital stock & 136.4 & 190.0 \\ \hline Retained earnings & & \\ \hline Totals & $910.0 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started