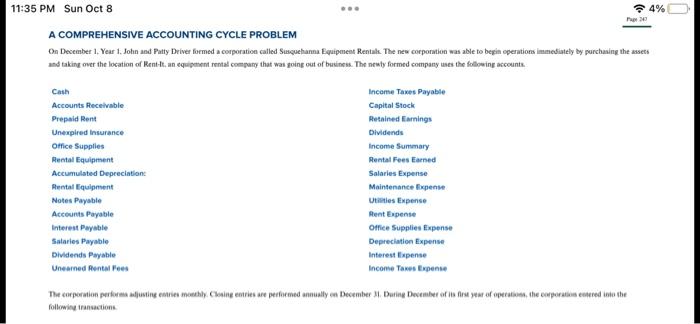

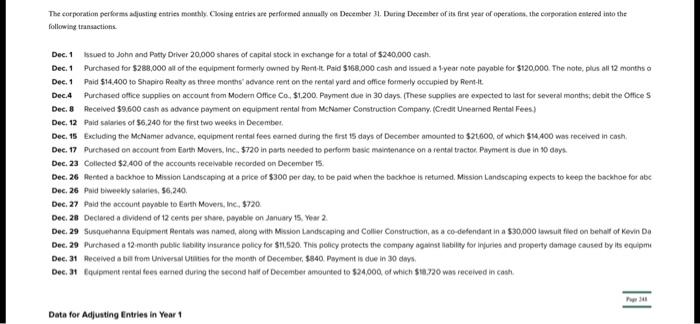

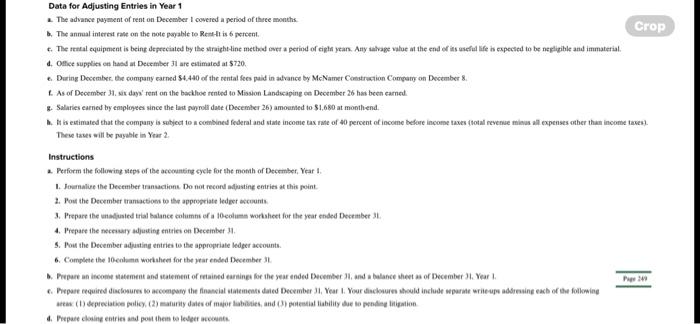

A COMPREHENSIVE ACCOUNTING CYCLE PROBLEM and taking over the location of Rent-ft, an equopent rental company that was goine out of bueiness. The newb formed company uses the folbovine accounts. Cash Accounts Peceivable Prepaid Rent Unempired insurance Otfice Supplies Rental Equipment Accumulated Depreciation: Aental Equipment Notes Paysble Accounts Payable intereat Payable Salaries Payable Dividends Payable Unearned Pental Fees Income Taxes Payable Capital Stock Retained Eamings Divldends incombe Summary Rental Fees Earned Salaries Expense Maintenance Fxpense Utiaties Expense Ment Erpense Otfice Supplies Expense Depreclation Expense Interest Expense income Taxes Erpense followine iransactions. following transactions. Dec. 1 lssued to John and Pacty Driver 20,000 shares of capital stock in exchange for a total of $240,000 cash. Dec, 1 Paid $14.400 so Shapira Realty as three month' acvance rent on the renesl yard and office formserly occupied by Remtit Dec, 8 Plecelved $9.600 cash as advance payment on equipment rental from McNomer Construction Compary. (Crectin Unearned Rentat Fees) Dec, 12 Paid sularies of $6.240 for the first two weeks in December. Dec, 17 Purchased en account frem Earth Movers. Ins. $720 in parts needed to perform basic mamenance on a rental tracter, Paymert is due in 10 days. Dec. 23 Collecled $2,400 of the accounts receivabie recorded on December is. Dec, 26 Paid biweekly salaries, 56,240. Dec, 27 Paid the account powsble to Earth Movers; inc, $720 Dec. 28 Deciared a dividend of 12 cems per share. parable on January 15 , wear 2 Dec, 31 Aleceived a bia from Universal utaties for the menth of Decenber, $840 Pwyment is due in 30 diry. Dec. It Equpment renal fees earned during the second half of December amounted to $24,000 of wich $ ta.720 was received in cash Data for Adjusting Entries in Year 1 2. The advance payment of rent on December 1 covered a period of thuce months. b. The annual imterest rate on the note payable to Resth is 6 pericent. 4. Ollice supplies en hasd at Decrimber 31 are entimated at $720. 2. As of December 3. six day' rent on the backlove rented to Misson Landscapine oe December 26 has been earned. g. Salaries earned by empleyees since the hast pugroll dase (December 26) amounted to $1,680 at monthend. Theve taus will be puyable in Year 2. Instructions 2. Ferform the following nteps of the aceoumbing cycle for the month of December, Year 1. 1. Jownalue the December tranactions. Do not record adpasting eniries at this point. 2. Pout the December traniaction to the appropriate leder ascounts: 3. Prepare the unalusied trial balance columns of a toeohume worksheet for the year ended December 31. 4. Prepare the necesarry adjuatide entries on Deceinber 11. 5. Pos the December adjusting entries to the appropriate ledger acounts. 6. Complete the 10 enhame workshed for the pear ended December 31