Answered step by step

Verified Expert Solution

Question

1 Approved Answer

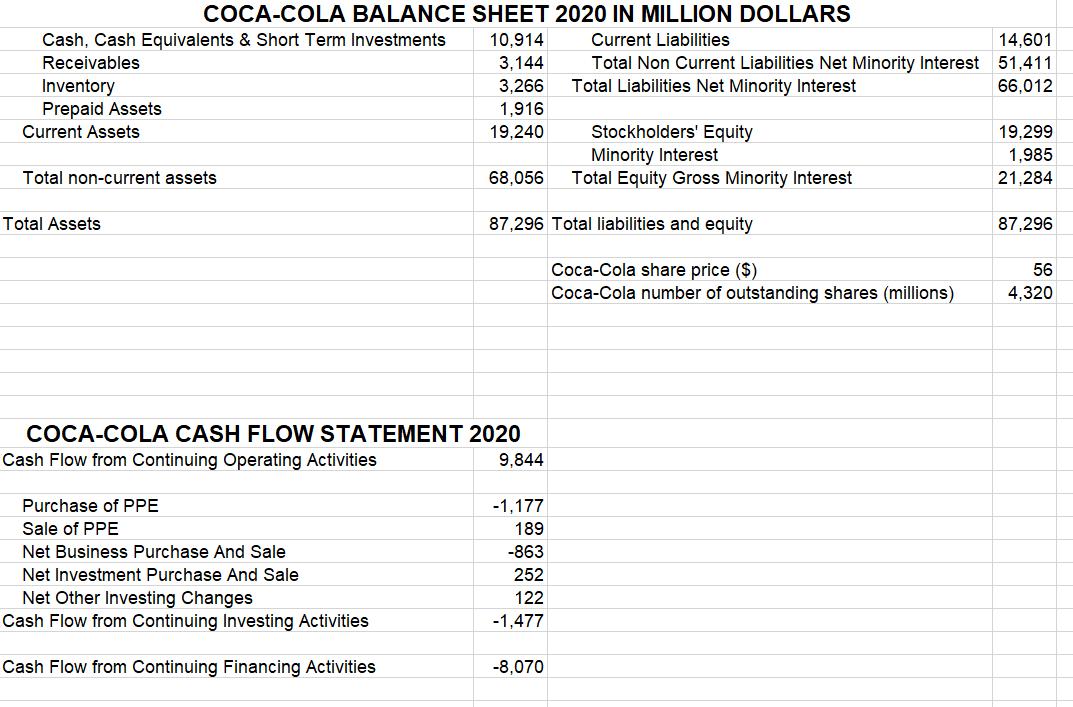

a) Compute Coca-Cola's enterprise value in 2020 using the accounting approach b) Compute Coca-Cola's enterprise value in 2020 using the efficient market approach COCA-COLA BALANCE

a) Compute Coca-Cola's enterprise value in 2020 using the accounting approach

b) Compute Coca-Cola's enterprise value in 2020 using the efficient market approach

| COCA-COLA BALANCE SHEET 2020 IN MILLION DOLLARS | |||

| Cash, Cash Equivalents & Short Term Investments | 10,914 | Current Liabilities | 14,601 |

| Receivables | 3,144 | Total Non Current Liabilities Net Minority Interest | 51,411 |

| Inventory | 3,266 | Total Liabilities Net Minority Interest | 66,012 |

| Prepaid Assets | 1,916 | ||

| Current Assets | 19,240 | Stockholders' Equity | 19,299 |

| Minority Interest | 1,985 | ||

| Total non-current assets | 68,056 | Total Equity Gross Minority Interest | 21,284 |

| Total Assets | 87,296 | Total liabilities and equity | 87,296 |

| Coca-Cola share price ($) | 56 | ||

| Coca-Cola number of outstanding shares (millions) | 4,320 | ||

a) Compute Coca-Cola's enterprise value in

COCA-COLA BALANCE SHEET 2020 IN MILLION DOLLARS Cash, Cash Equivalents & Short Term Investments 10,914 Current Liabilities 14,601 Receivables 3,144 Total Non Current Liabilities Net Minority Interest 51,411 Total Liabilities Net Minority Interest Inventory Prepaid Assets 3.266 66,012 1,916 Stockholders' Equity 19,299 1,985 Current Assets 19,240 Minority Interest Total Equity Gross Minority Interest Total non-current assets 68,056 21,284 Total Assets 87,296 Total liabilities and equity 87,296 Coca-Cola share price ($) Coca-Cola number of outstanding shares (millions) 56 4,320 COCA-COLA CASH FLOW STATEMENT 2020 Cash Flow from Continuing Operating Activities 9,844 Purchase of PPE -1,177 Sale of PPE 189 Net Business Purchase And Sale -863 Net Investment Purchase And Sale 252 Net Other Investing Changes Cash Flow from Continuing Investing Activities 122 -1,477 Cash Flow from Continuing Financing Activities -8,070

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

FCF0 Current FCF Cash Flow from Operating Activities Cash Flow from Investing Activities Cash Flow f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started