Question

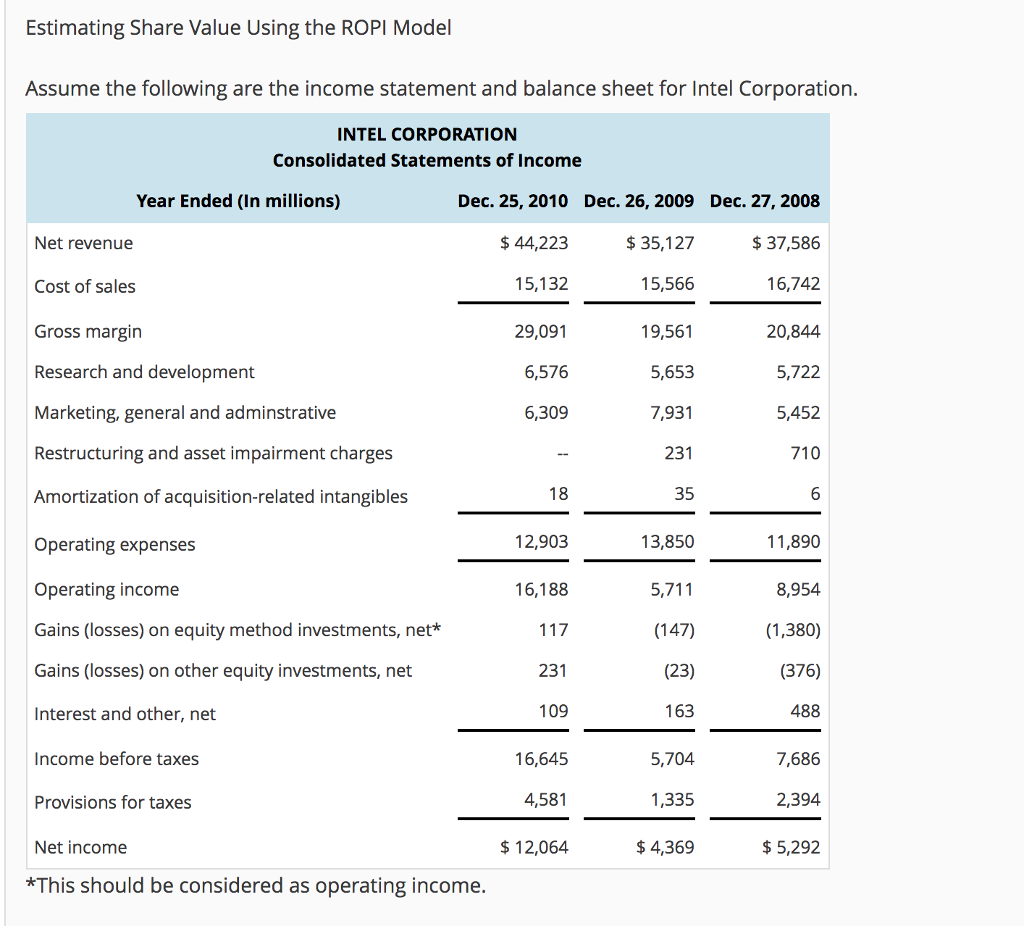

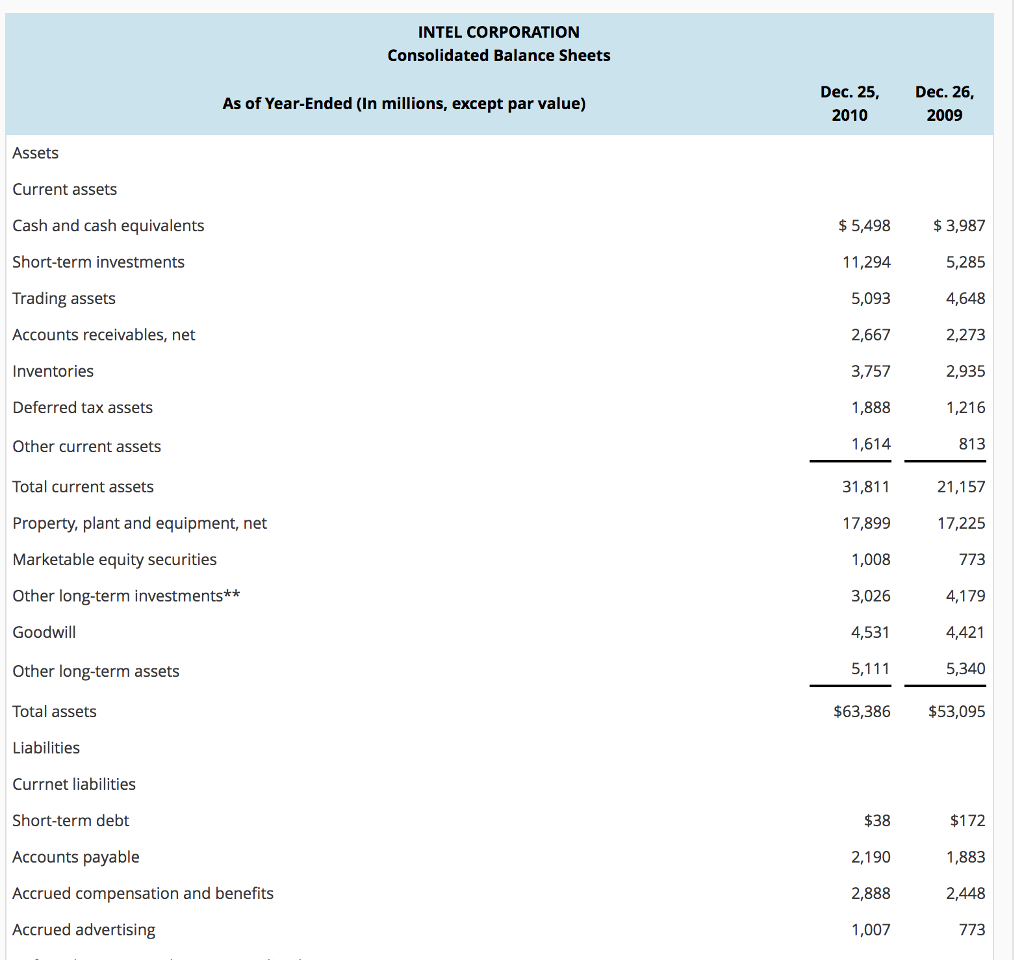

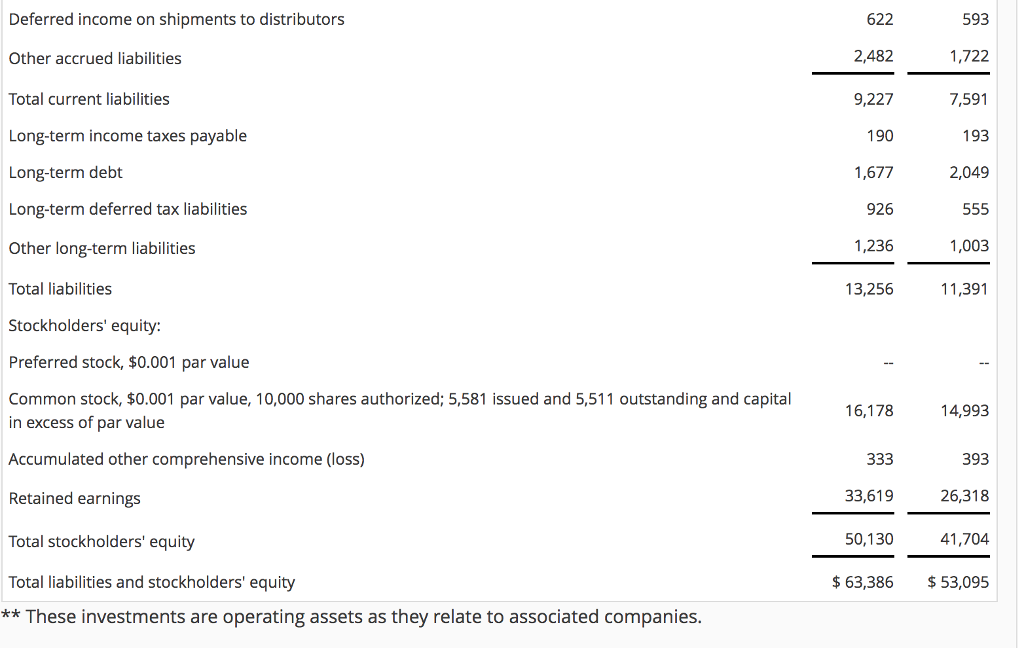

(a) Compute Intel's net operating assets (NOA) for year-end 2010. 2010 NOA = $Answer (b) Compute net operating profit after tax (NOPAT) for 2010, assuming

(a) Compute Intel's net operating assets (NOA) for year-end 2010. 2010 NOA = $Answer (b) Compute net operating profit after tax (NOPAT) for 2010, assuming a federal and state tax rate of 37%.

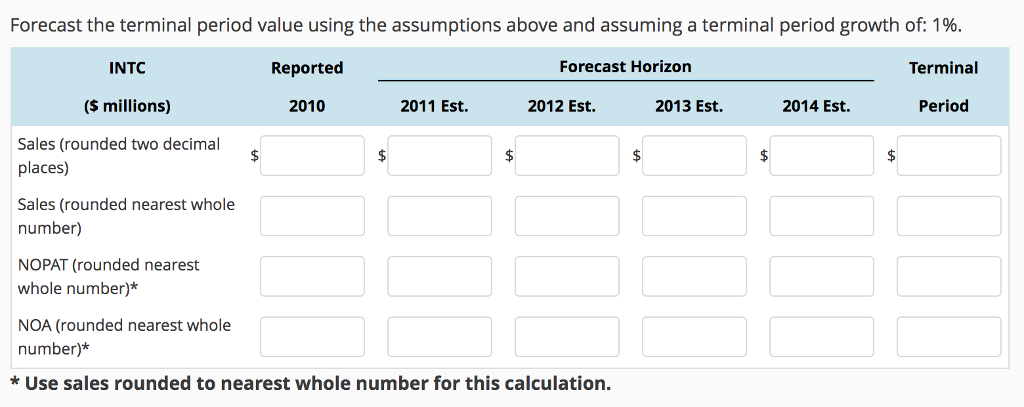

HINT: Gains/losses on equity method investments are considered operating income. Round your answer to the nearest whole number. 2010 NOPAT = $Answer (c) Forecast Intel's sales, NOPAT, and NOA for years 2011 through 2014 using the following assumptions:

| Sales growth | 10% |

| Net operating profit margin (NOPM) | 26% |

| Net operating asset turnover (NOAT) at fiscal year-end 1.50

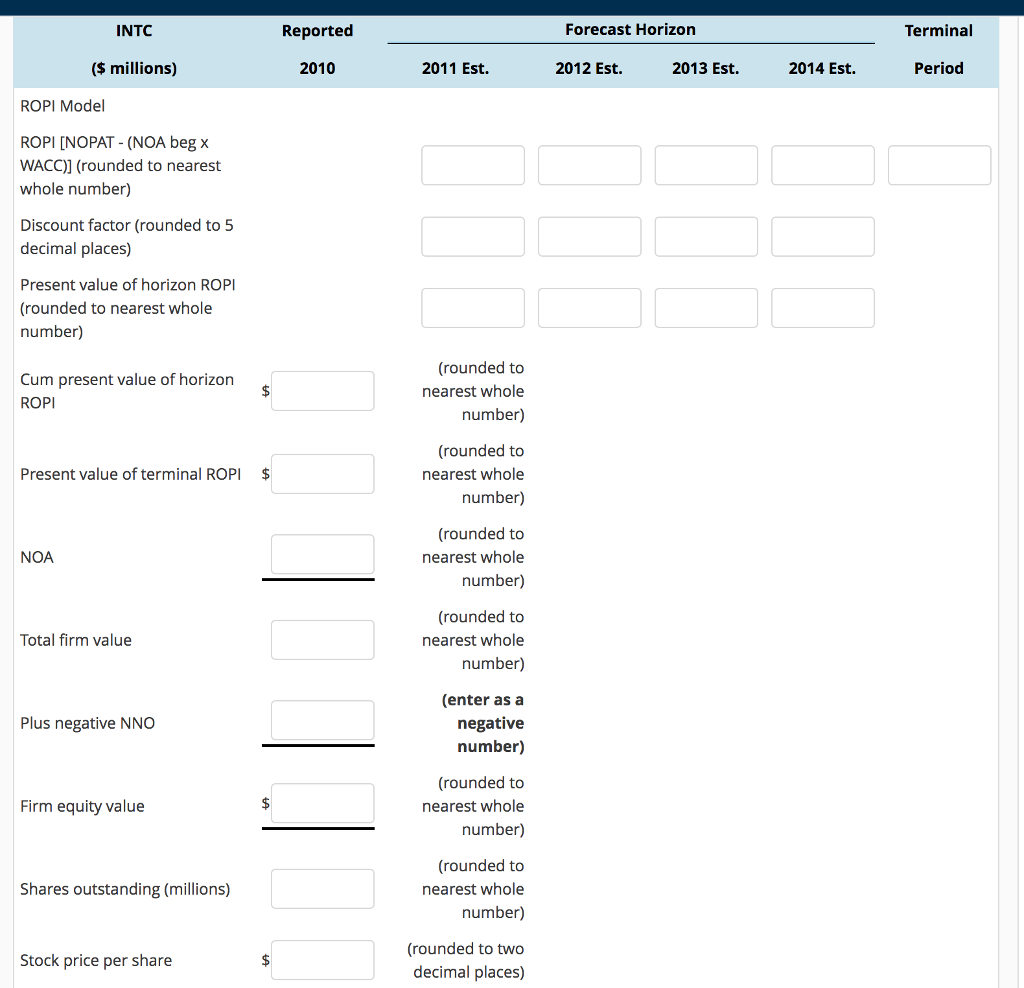

(d) Estimate the value of a share of Intel common stock using the residual operating income (ROPI) model as of December 25, 2010; assume a discount rate (WACC) of 11%, common shares outstanding of 5,511 million, and net nonoperating obligations (NNO) of $(21,178) million (NNO is negative which means that Intel has net nonoperating investments). Use your rounded answers for subsequent calculations.

(e) Intel (INTC) stock closed at $22.14 on February 18, 2011. How does your valuation estimate compare with this closing price? What do you believe are some reasons for the difference? What investment decision is suggested from your results? (Select all that apply) Answeryesno Our stock price estimate is higher than the INTC market price as of February 18, 2011, indicating that we believe the stock is undervalued. Answeryesno Our lower stock price estimate may be due to more pessimistic forecasts or a higher discount rate compared to other investors' and analysts model assumptions. Answeryesno Stock prices are a function of expected NOPAT and NOA, as well as the WACC discount rate. Answeryesno Our higher stock price estimate may be due to more optimistic forecasts or a lower discount rate compared to other investors' and analysts model assumptions. |

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started