Question

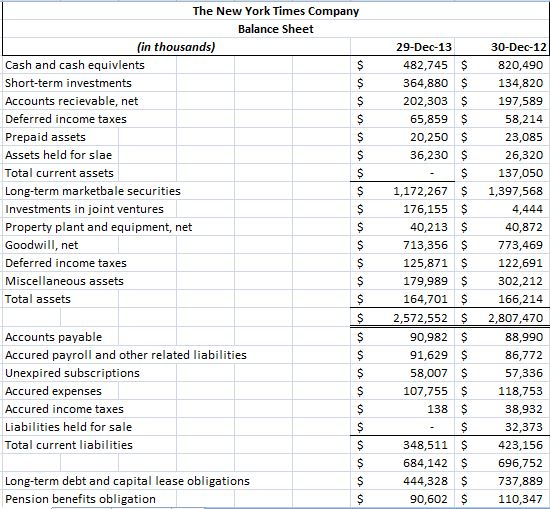

a. Compute net operating profit after tax (NOPAT) for 2013 and 2012. Assume that combined federal and state statory tax rates are 37% for both

a. Compute net operating profit after tax (NOPAT) for 2013 and 2012. Assume that combined federal and state statory tax rates are 37% for both years.

b. Compute net operating assets (NOA) for 2013 and 2012

c. Compute return on net operating assets (RNOA) for 2013 and 2012. Net operating assets are $12, 630 thousand in 2011.

d. Compute return on common shareholders equity (ROE) for 2013 and 2012. Stockholders'equity attributable to New York Times Company in 2011 is $506,360 thousand.

e. What is nonoperating return component of ROE for 2013 and 2012?

Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

The New York Times Company Balance Sheet 30-Dec-12 (in thousands) 29-Dec-13 482,745 820,490 Cash and cash equivients 134,820 364,880 Short-term investments Accounts recievable, net 202,303 197,589 R$ Deferred income taxes 65,859 58,214 20,250 s 23,085 Prepaid assets Assets held for slae 36,230 s 26,320 137,050 Total current assets 1,172,267 1,397,568 Long-term marketbale securities 4,444 176,155 Investments in joint ventures 40,213 40,872 Property plant and equipment, net s 713,356 773,469 Goodwill, net R$ 125,871 122,691 Deferred income taxes 179,989 s 302,212 Miscellaneous assets Total assets 164,701 166,214 2,572,552 2,807,470 90,982 Accounts payable 91,629 86,772 Accured payroll and other related liabilities 58,007 57,336 Unexpired subscriptions S 107,755 S 118,753 Accured expenses Accured income taxes 138 38,932 Liabilities held for sale s 32373 348,511 423,156 Total current liabilities 696,752 684,142 444,328 737,889 Long-term debt and capital lease obligations 110,347 90,602 Pension benefits obligationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started